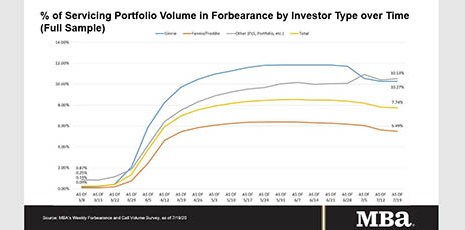

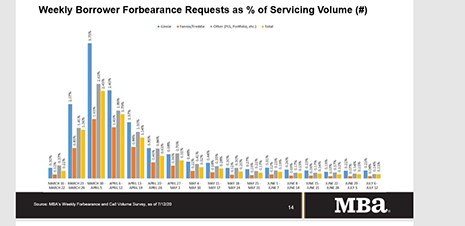

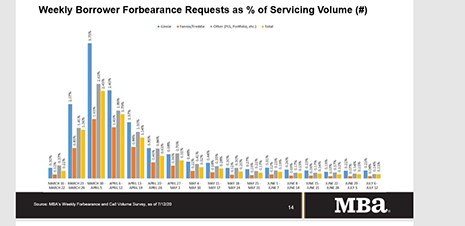

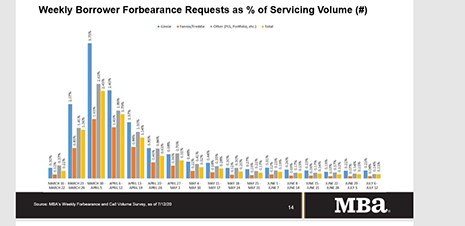

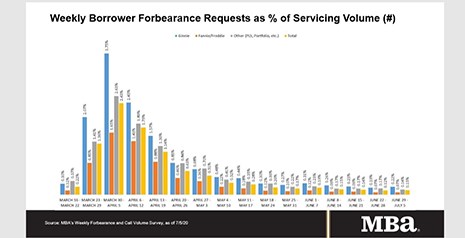

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 6 basis points to 7.74% of servicers’ volume as of July 19, from 7.80% the prior week. MBA now estimates 3.9 million homeowners are in forbearance plans.

Tag: Ginnie Mae

MBA: Share of Loans in Forbearance Falls for 6th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 6 basis points to 7.74% of servicers’ volume as of July 19, from 7.80% the prior week. MBA now estimates 3.9 million homeowners are in forbearance plans.

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

FHLB of Des Moines, Ginnie Mae Get on the eNote Bus

Last week saw a few speed bumps leveled in the road to the complete digital mortgage, with the Federal Home Loan Bank of Des Moines and Ginnie Mae announcing they would begin accepting residential mortgage electronic promissory notes—eNotes—as collateral.

FHLB of Des Moines, Ginnie Mae Get on the eNote Bus

This week saw a few speed bumps leveled in the road to the complete digital mortgage, with the Federal Home Loan Bank of Des Moines and Ginnie Mae announcing they would begin accepting residential mortgage electronic promissory notes—eNotes—as collateral.

MBA Urges House to Support FY2021 T-HUD Priorities

The Mortgage Bankers Association, in a July 14 letter to House leadership, urged the House to approve key industry-supported provisions for FHA in the federal government’s fiscal 2021 proposed budget.

MBA Urges House to Support FY2021 T-HUD Priorities

The Mortgage Bankers Association, in a July 14 letter to House leadership, urged the House to approve key industry-supported provisions for FHA in the federal government’s fiscal 2021 proposed budget.

MBA: Share of Loans in Forbearance Falls 4th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 21 basis points to 8.18% of servicers’ portfolio volume for the week of July 5, from 8.39% the week before. MBA now estimates 4.1 million homeowners are in forbearance plans, down from 4.2 million the previous week.