The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 15 basis points last week to 7.01% of mortgage servicers’ portfolio volume as of Sept. 6, down from 7.16% the previous week. According to MBA estimates 3.5 million homeowners are in forbearance plans.

Tag: Ginnie Mae

MBA: Share of Mortgage Loans in Forbearance Declines to 7.16%

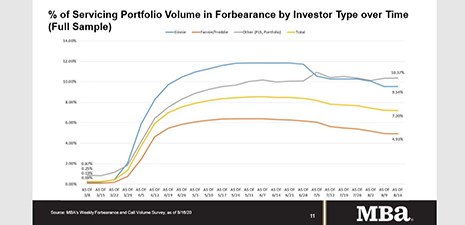

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the total number of loans now in forbearance decreased 4 basis points to 7.16 percent of servicers’ portfolio volume as of Aug. 30.

MBA: Share of Mortgage Loans in Forbearance Flat at 7.20%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the percentage of loans in forbearance stayed flat for the second straight week, holding at 7.20% as of Aug. 23.

MBA: Share of Mortgage Loans in Forbearance Flat at 7.20%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the percentage of loans in forbearance stayed flat for the second straight week, holding at 7.20% as of Aug. 23.

MBA: Share of Mortgage Loans in Forbearance Flat

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by just 1 basis point, from 7.20% of servicers’ portfolio volume as of Aug. 16 from the prior week. MBA estimates 3.6 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Flat

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by just 1 basis point, from 7.20% of servicers’ portfolio volume as of Aug. 16 from the prior week. MBA estimates 3.6 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Flat

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by just 1 basis point, from 7.20% of servicers’ portfolio volume as of Aug. 16 from the prior week. MBA estimates 3.6 million homeowners are in forbearance plans.

MBA: Loans in Forbearance Fall 9th Straight Week

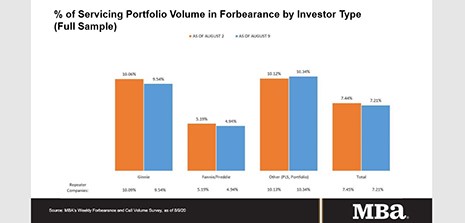

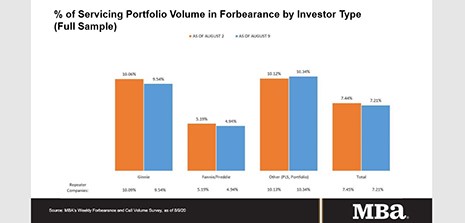

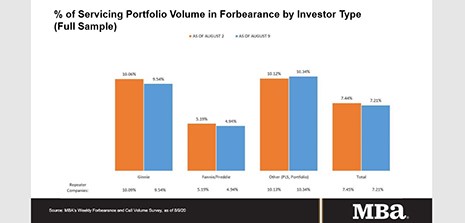

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 23 basis points to 7.21% of servicers’ portfolio volume the week of Aug. 9 from 7.44% the previous week. MBA estimates 3.6 million homeowners are in forbearance plans.

MBA: Loans in Forbearance Fall 9th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 23 basis points to 7.21% of servicers’ portfolio volume the week of Aug. 9 from 7.44% the previous week. MBA estimates 3.6 million homeowners are in forbearance plans.

MBA: Loans in Forbearance Fall 9th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 23 basis points to 7.21% of servicers’ portfolio volume the week of Aug. 9 from 7.44% the previous week. MBA estimates 3.6 million homeowners are in forbearance plans.