The 30-year fixed-rate mortgage averaged 2.86 percent last week, the lowest rate since at least 1971, reported Freddie Mac, McLean, Va.

Tag: Freddie Mac

Mortgage Rates Fall to Record Low

The 30-year fixed-rate mortgage averaged 2.86 percent last week, the lowest rate since at least 1971, reported Freddie Mac, McLean, Va.

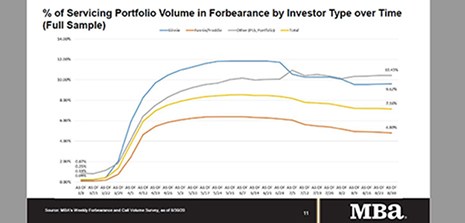

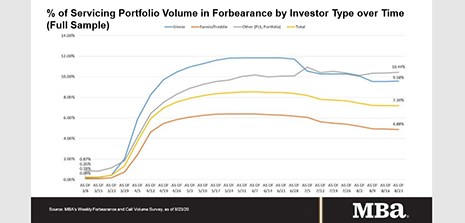

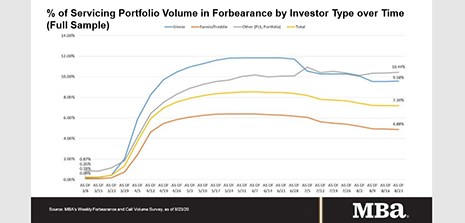

MBA: Share of Mortgage Loans in Forbearance Declines to 7.16%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the total number of loans now in forbearance decreased 4 basis points to 7.16 percent of servicers’ portfolio volume as of Aug. 30.

Dealmaker: NorthMarq Secures $84M in Fannie Mae, Freddie Mac Financing

NorthMarq, Minneapolis, arranged $83.9 million in Fannie Mae and Freddie Mac financing for apartment properties in Missouri and North Dakota.

Dealmaker: Bellwether Enterprise Closes $98M

Bellwether Enterprise, Cleveland, arranged $97.5 million to refinance seniors apartments in California and workforce housing in Fargo, N.D.

MBA Offers Recommendations to FHFA on New GSE Capital Framework

The Mortgage Bankers Association asked the Federal Housing Finance Agency to restructure the capital framework for Fannie Mae and Freddie Mac, moving from past business models to a market utility approach that enables them to meet all of their obligations.

MBA Offers Recommendations to FHFA on New GSE Capital Framework

The Mortgage Bankers Association asked the Federal Housing Finance Agency to restructure the capital framework for Fannie Mae and Freddie Mac, moving from past business models to a market utility approach that enables them to meet all of their obligations.

MBA: Share of Mortgage Loans in Forbearance Flat at 7.20%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the percentage of loans in forbearance stayed flat for the second straight week, holding at 7.20% as of Aug. 23.

MBA: Share of Mortgage Loans in Forbearance Flat at 7.20%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the percentage of loans in forbearance stayed flat for the second straight week, holding at 7.20% as of Aug. 23.

MBA Advocacy Update Sept. 1, 2020

On Tuesday, the Federal Housing Finance Agency announced steps to limit the impact on both lenders and consumers of its newly issued 50-basis-point GSE Adverse Market Refinance Fee. Following two weeks of sustained MBA-led advocacy with its coalition partners, FHFA delayed the implementation date of the fee from September 1 to December 1.