The Federal Housing Finance Agency said Fannie Mae and Freddi Mac completed 252,014 foreclosure prevention actions in the second quarter, bringing to 4.68 million the number of troubled homeowners who have been helped during conservatorships.

Tag: Freddie Mac

MBA: Loans in Forbearance Fall to 5-Month Low

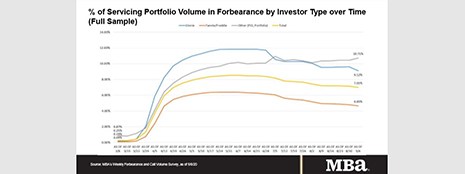

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 8 basis points to 6.93% of servicers’ portfolio volume as of Sept. 13, compared to 7.01% the week before. MBA estimates 3.5 million homeowners are in forbearance plans.

Freddie Mac 2Q Apartment Investment Index Dips from Pandemic Impact

Freddie Mac, McLean, Va., said its Multifamily Apartment Investment Market Index fell by 0.3% in the second quarter following strong previous quarterly gains, reflecting the impact of the coronavirus pandemic and the first negative second quarter net operating income growth since 2009.

MBA: Loans in Forbearance Fall to Lowest Level in 5 Months

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 8 basis points to 6.93% of servicers’ portfolio volume as of Sept. 13, compared to 7.01% the week before. MBA estimates 3.5 million homeowners are in forbearance plans.

MBA: Loans in Forbearance Fall to 5-Month Low

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 8 basis points to 6.93% of servicers’ portfolio volume as of Sept. 13, compared to 7.01% the week before. MBA estimates 3.5 million homeowners are in forbearance plans.

GSEs: Recession-Era QC Has Lenders Well-Prepared for Current Crisis (MBA LIVE)

Speaking virtually at the Mortgage Bankers Association’s Risk Management, Quality Assurance and Fraud Prevention Forum, GSE analysts said despite challenges resulting from increased volumes, economic instability and a sharp spike in unemployment–as well an abrupt shift to remote working–lenders have shown adaptability and a commitment to loan quality.

GSEs: Recession-Era QC Has Lenders Well-Prepared for Current Crisis (MBA LIVE)

Speaking virtually at the Mortgage Bankers Association’s Risk Management, Quality Assurance and Fraud Prevention Forum, GSE analysts said despite challenges resulting from increased volumes, economic instability and a sharp spike in unemployment–as well an abrupt shift to remote working–lenders have shown adaptability and a commitment to loan quality.

Dealmaker: M&T Realty Capital Corp. Provides $124M for Multifamily

M&T Realty Capital Corp., Baltimore, closed $123.9 million in Fannie Mae and Freddie Mac multifamily loans.

MBA: Share of Mortgage Loans in Forbearance Declines to 7.01%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 15 basis points last week to 7.01% of mortgage servicers’ portfolio volume as of Sept. 6, down from 7.16% the previous week. According to MBA estimates 3.5 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Declines to 7.01%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 15 basis points last week to 7.01% of mortgage servicers’ portfolio volume as of Sept. 6, down from 7.16% the previous week. According to MBA estimates 3.5 million homeowners are in forbearance plans.