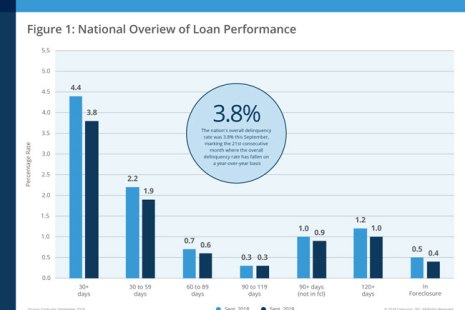

CoreLogic, Irvine, Calif., reported just 3.7% of mortgages in some stage of delinquency in December, the lowest for a December in more than 20 years.

Tag: Frank Nothaft

CoreLogic: January Home Prices Up 4% Year Over Year

CoreLogic, Irvine, Calif., said January home prices rose both year over year and month over month. Home prices increased nationally by 4% from a year ago; on a month-over-month basis, prices increased by 0.1%

S&P: Home Prices Continue Modest Growth

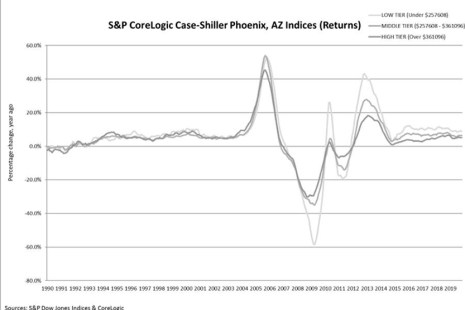

S&P Dow Jones Indices, New York, said its S&P CoreLogic Case-Shiller Indices showed home prices continue to increase at a modest rate across the U.S through the end of 2019.

CoreLogic: 2019 Home Prices Increased by 4%

CoreLogic, Irvine, Calif, said home prices increased by 4 percent annually in December—not as high as other forecasts, but at a healthier pace than in recent years.

Home Prices Post Strong Annual Gains

Standard & Poor’s, New York, reported its S&P CoreLogic Case-Shiller Home Price Indexes posted a 3.5% annual gain in November, up from 3.2% the previous month.

CoreLogic: October Delinquency Rate Hits 20-Year Low

CoreLogic, Irvine, Calif., reported 3.7% of mortgages were in some stage of delinquency in October, an 0.4 percentage point decline from a year ago.

CoreLogic: November Home Prices Increase by 3.7% from Year Ago

CoreLogic, Irvine, Calif., reported this morning home prices rose both year over year and month over month in November. Home prices increased nationally by 3.7% from a year ago; on a month-over-month basis, prices increased by 0.5% from October.

S&P: Home Prices Post 3.3% Annual Gain

The S&P CoreLogic Case-Shiller Home Price Indices reported a 3.3% annual gain in October, up from 3.2% in the previous month.

Homeowners Gained $5,300 in Equity in Third Quarter on Average

U.S. homeowners with mortgages have seen their equity increase by 5.1 percent year-over-year, representing a nearly $457 billion gain since third-quarter 2018.

CoreLogic: 78,000 Single-Family Properties Regained Equity in 3Q

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages–representing 64% of all properties–saw their equity increase by 5.1% year over year in the third quarter, a gain of nearly $457 billion from a year ago.