Home Prices Post Strong Annual Gains

Standard & Poor’s, New York, reported its S&P CoreLogic Case-Shiller Home Price Indexes posted a 3.5% annual gain in November, up from 3.2% the previous month.

The report said the 10-City Composite annual increase came in at 2.0% in November, up from 1.7% in October. The 20-City Composite posted a 2.6% year-over-year gain, up from 2.2% in October.

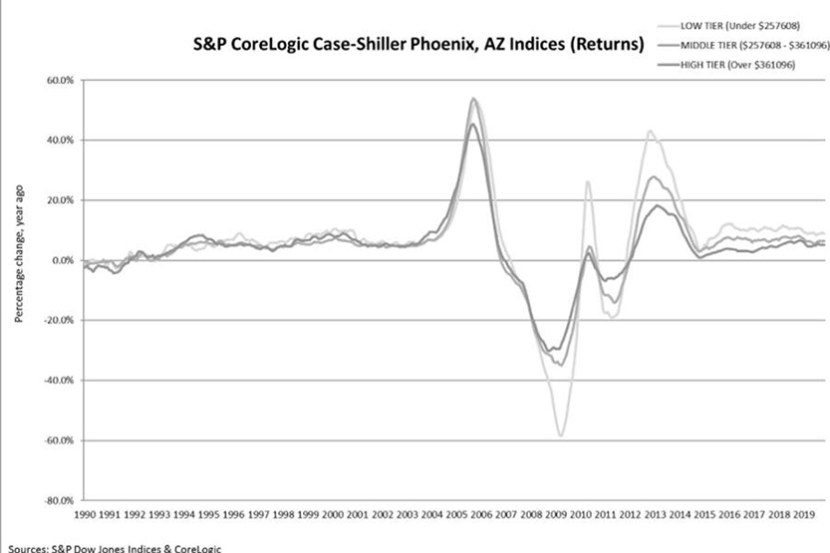

Among the 20 cities, Phoenix led with a 5.9% year-over-year price increase, followed by Charlotte at 5.2% and Tampa at 5%. Fifteen of the 20 cities reported greater price increases in the year ending November from October.

Month over month, the National Index posted an increase of 0.2%, while the 10-City and 20-City Composites both posted a month-over-month increase of 0.1% before seasonal adjustment in November. After seasonal adjustment, the National Index, 10-City and 20-City Composites all posted 0.5% increases. Thirteen of 20 cities reported increases before seasonal adjustment, while all 20 cities reported increases after seasonal adjustment.

“The U.S. housing market was stable in November,” said Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy with S&P Dow Jones Indices. “With the month’s 3.5% increase in the national composite index, home prices are currently 59% above the trough reached in February 2012, and 15% above their pre-financial crisis peak. November’s results were broad-based, with gains in every city in our 20-city composite.

Lazzara noted after a long period of decelerating price increases, the National, 10-city, and 20-city Composites all rose at a modestly faster rate in November than they had done in October. “This increase was broad-based, reflecting data in 15 of 20 cities,” he said. “It is, of course, still too soon to say whether this marks an end to the deceleration or is merely a pause in the longer-term trend.”

“Homes are in big demand in markets with a fast-growing population,” said Frank Nothaft, chief economist for CoreLogic. Add in low mortgage rates, family income growth, and a limited inventory of homes for sale and that translates into home-price growth that surpasses overall inflation on other consumer products.”

The report said as of November, average home prices for metros within the 10-City and 20-City Composites are back to their winter 2007 levels.