Stewart Appraisals Management Inc., Houston, announced its acquisition of Pro-Teck Services Ltd., DBA Pro Teck Valuation Intelligence.

Tag: Fitch Ratings

Housing Market Roundup

It’s been a busy week here, with the Mortgage Bankers Association’s Annual Convention & Expo wrapping up. Here is a summary of some key housing market reports that took place over the past week. A major theme: tremendous housing market resiliency amid continued economic turmoil.

What to Expect When Expecting Distress: A Servicer Roundtable

As COVID-19 and government responses continue to drive uncertainty around outcomes and outlooks, MBA Newslink interviewed senior professionals from a credit rating agency and several highly rated servicers to get their perspective on forbearance, loan workouts and portfolio management challenges for agency and non-agency CMBS.

What to Expect When Expecting Distress: A Servicer Roundtable

As COVID-19 and government responses continue to drive uncertainty around outcomes and outlooks, MBA Newslink interviewed senior professionals from a credit rating agency and several highly rated servicers to get their perspective on forbearance, loan workouts and portfolio management challenges for agency and non-agency CMBS.

What to Expect When Expecting Distress: A Servicer Roundtable

As COVID-19 and government responses continue to drive uncertainty around outcomes and outlooks, MBA Newslink interviewed senior professionals from a credit rating agency and several highly rated servicers to get their perspective on forbearance, loan workouts and portfolio management challenges for agency and non-agency CMBS.

Forecasts See Little Letup in Home Price Growth, Despite Coronavirus

Reports from Veros Real Estate Solutions, Santa Ana, Calif., and Fitch Ratings, New York, said home prices will continue to climb, despite the coronavirus pandemic, well through 2021.

Fitch: Remote Working to Affect Housing Demand—But Not U.S. RMBS Ratings

Fitch Ratings, New York, said while remote working in the U.S. accelerated as a result of the coronavirus pandemic, and is reducing the importance of proximity to offices and causing migration from urban to suburban and exurban areas, it does not expect any material effect on the credit quality of its rated U.S. residential mortgage-backed securities pools.

Life Insurers Brace for Higher Commercial Mortgage Losses

Fitch Ratings, New York, said life insurance companies could see higher losses on commercial mortgage loans than they saw during the Great Recession.

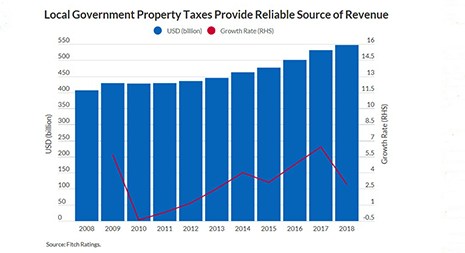

Fitch: Mortgage Delinquencies Won’t Affect Property Tax Payments

Fitch Ratings, New York, does not expect fiscal 2021 property tax collections to be meaningfully affected by mortgage forbearance programs or delinquencies, but potential for timing delays is “elevated.”

Fitch: Secular Shifts Force U.S. Commercial Real Estate to Adapt

Fitch Ratings, New York/London, said post-pandemic, many U.S. commercial real estate segments will be transformed by the way space is used, which will have long-term consequences for property performance and financeability.