Life Insurers Brace for Higher Commercial Mortgage Losses

Fitch Ratings, New York, said life insurance companies could see higher losses on commercial mortgage loans than they saw during the Great Recession.

The pessimistic forecast reflects both the severity of the pandemic fallout and the slow pace of the expected recovery, Fitch said.

“We expect elevated losses from the coronavirus pandemic to begin to emerge at the earliest in the 3Q20 statutory statements,” the report said. “Loss expectations are vulnerable to revisions given the high degree of uncertainty associated with the pandemic’s longer-term economic fallout.”

So far, those losses have not materialized in force. Yesterday the Mortgage Bankers Association’s CREF Loan Performance Survey reported 1.9 percent of life company loan balances were delinquent in September, down from 2.4 percent in August.

Fitch called the credit metrics of life insurers’ performing commercial mortgages high. “However, the credit quality of commercial mortgages declined for the second consecutive year, denoting a weakening trend,” the report said.

Under Fitch’s base-case loss assumptions, the ratings firm anticipates commercial mortgage loan losses will amount to 180 basis points, a 50 percent increase from levels seen during the Great Recession. The report noted loss recognition on commercial mortgage loans typically lags other asset classes, including equities and bonds. “The timing of losses is also subject to regulatory forbearance actions, which may extend into next year,” it said.

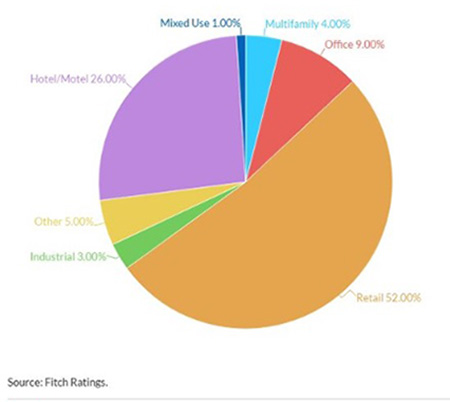

Life insurance companies have granted relief measures on 9 percent of commercial real estate mortgages by outstanding balance on average, Fitch said. Retail and hotel borrowers accounted for nearly 80 percent of all mortgage loans held by life insurers with approved relief measures. “While hotel loans were more affected by the pandemic, retail loans account for a much larger share of total commercial mortgages held by U.S. life insurers,” the report said.The office sector could also see near-term cyclical pressures and greater uncertainty over the longer term as the pandemic’s effects remain unclear. Increased working from home could decrease the demand for office space, particularly in urban areas, Fitch said.

The office sector could also see near-term cyclical pressures and greater uncertainty over the longer term as the pandemic’s effects remain unclear. Increased working from home could decrease the demand for office space, particularly in urban areas, Fitch said.