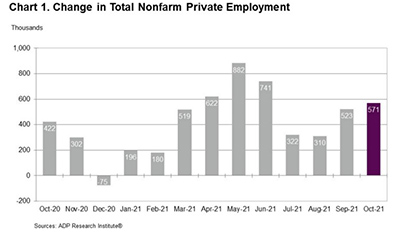

In the first of several major reports this week on U.S. employment, ADP, Roseland, N.J., said private-sector employment increased by 571,000 jobs from September to October.

Tag: Fitch Ratings

Industry Briefs Oct. 13, 2021: Ginnie Mae Reports Record Fiscal Year MBS Issuance

Ginnie Mae, Washington, D.C., reported mortgage-backed securities issuance volume for fiscal year 2021 grew to a record $939 billion, with issuance for September coming in at $73 billion.

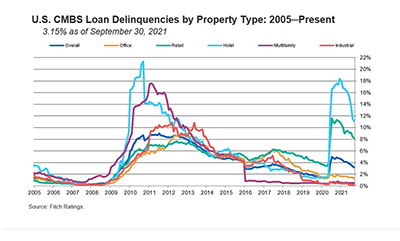

September CMBS Delinquency, Special Servicing Rates Drop

Fitch Ratings, New York, and Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate continued it steady fall in September.

Industry Briefs Oct. 6, 2021: WFG Whitepaper Examines Title Agent-Underwriter Relationship

WFG National Title Insurance Co., Portland Ore., published a new whitepaper that explores the title agent-underwriter relationship in great detail. The paper, “Creating a True Partnership Between Title Agencies and Underwriters,” is available as a free download on the WFG Blocks website.

CMBS Delinquency Rate Shrinks, Cumulative Default Rate Increases

The commercial mortgage-backed securities delinquency rate continues to shrink, but the cumulative loan default rate increased slightly in first-half 2021, according to two new reports from S&P Global Ratings and Fitch Ratings.

Industry Briefs Sept. 24, 2021: CFPB Says Renters at Risk as COVID Safety Net Ends

The Consumer Financial Protection Bureau released a report warning that millions of renters and their families may suffer previously avoided economic harms of the COVID-19 pandemic as federal and state relief programs end.

Fitch Ratings: The Future of New York Office Space

As the largest U.S. office market, New York provides a good case study of possible pandemic pressures on office demand, said Fitch Ratings, New York.

Housing Market Roundup Sept. 21, 2021

It’s another busy week for housing reports—and it’s only Tuesday! Here are some reports of interest that crossed the MBA NewsLink desk:

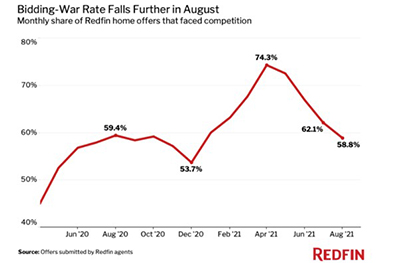

Housing Market Roundup: Bidding Wars; Remote Work; the Return of Non-QM

Here’s a quick summary of housing industry reports coming across the NewsLink desk.

Housing Market Roundup: Bidding Wars; Remote Work; the Return of Non-QM

It’s already been a busy week for housing industry reports–and it’s only Wednesday! Here’s a quick summary of some of those coming across the NewsLink desk.