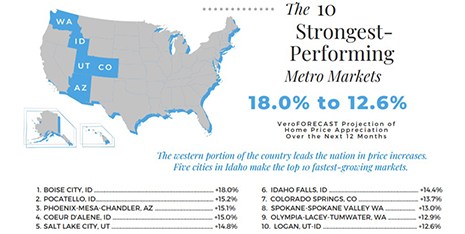

Add Veros Real Estate Solutions, Santa Ana, Calif., to the list of forecasters who say home price appreciation won’t let up any time soon. And add Fitch Ratings, New York, to those saying the home price train can’t run forever, with some markets highly overvalued.

Tag: Fitch Ratings

‘New Cracks’ in Affordable Housing Foundation

Fitch Ratings, New York, said the coronavirus pandemic “created new cracks” in the already fragile foundation of affordable housing.

Industry Briefs June 25, 2021

Lodasoft, Livonia, Mich., integrated with the Optimal Blue PPE engine through Black Knight, Jacksonville, Fla. The integration enables mortgage lenders to deliver Optimal Blue PPE pricing workflows into Lodasoft’s platform

Most Senior CMBS Found ‘Resilient’ Under Stress Test

Most high investment-grade rated commercial mortgage-backed securities multi-borrower bonds can withstand downgrades under a new hypothetical stress test, Fitch Ratings reported last week.

Industry Briefs June 18, 2021

Fannie Mae, Washington, D.C., said economic growth expectations for full-year 2021 were revised modestly upward to 7.1 percent, one-tenth higher than the previous forecast, due to stronger-than-expected consumer spending data year to date.

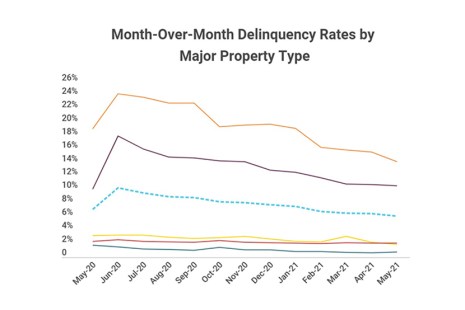

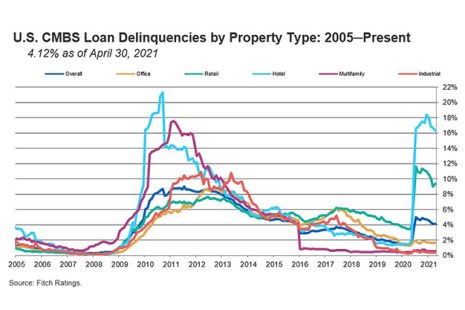

CMBS Delinquency Rate Improvement Reaches 11-Month Mark

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined again in May, posting its biggest drop in three months.

Industry Briefs June 4, 2021

Zillow, Seattle, said Asian-headed households in the U.S. grew by 83% in the past two decades, far exceeding Latinx, Black, and white household growth. But that broad success masks major challenges to homeownership in the highly diverse community.

Fitch: Urban Multifamily Recovery ‘Years Away’ Despite Recent Demand Growth

Urban multifamily rental demand is improving as pandemic restrictions are lifted and workers return to offices, but a full recovery could take longer than prior recoveries, reported Fitch Ratings, New York.

Industry Briefs May 27, 2021

Enact Holdings Inc., Raleigh, N.C., a provider of private mortgage insurance through its insurance subsidiaries, introduced its new brand and visual identity. Formerly known as Genworth Mortgage Holdings Inc., Enact is a wholly owned operating subsidiary of Genworth Financial Inc.

CMBS Delinquencies Tick Up; Special Servicing Rate Drops

The commercial mortgage-backed securities delinquency rate and special servicing rate moved in opposite directions in April, two new reports said.