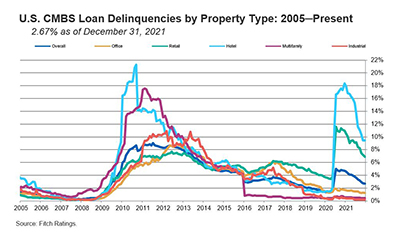

Fitch Ratings, New York, said the commercial mortgage-backed securities delinquency rate dipped nine basis points in December to 2.67 percent, driven by robust new issuance, continued loan resolutions and fewer new delinquencies.

Tag: Fitch Ratings

CMBS Delinquency, Special Servicing Rates Fall

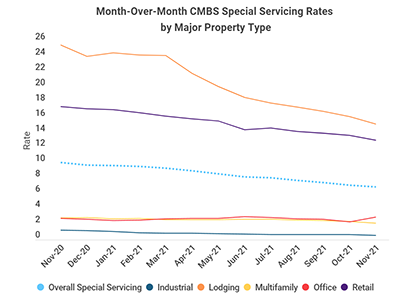

Trepp, New York, reported both the commercial mortgage-backed securities delinquency rate and special servicing rate dropped in November.

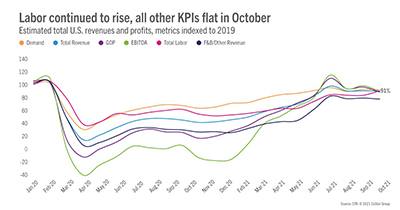

Hotel Profits, Recovery Forecast Improve

U.S. hotel profitability increased in October, and the sector’s recovery trajectory forecast has improved, STR and Fitch Ratings reported.

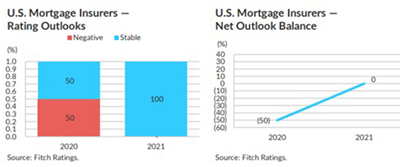

Fitch: Mortgage Insurers See Consistent Losses, Market Stability in 2022

Fitch Ratings, Chicago, said the operating environment for U.S. mortgage insurers is expected to remain steady in 2022, as economic indicators have generally improved since the low point of the pandemic, with lower than expected losses from the pandemic fallout and continued home price appreciation supportive of credit fundamentals of the rated peer group of private MIs.

Industry Briefs Nov. 23, 2021: Fitch Says Banks Relatively Unscathed by Pandemic

Fitch Rating, New York, said global financial institutions’ credit ratings have been affected less severely by the pandemic than by the two previous crises this century.

Industry Briefs Nov. 17, 2021: nCino to Acquire SimpleNexus for $1.2 Billion

nCino, Wilmington, N.C., announced it will acquire SimpleNexus, Lehi, Utah, for $1.2 billion.

Fitch: REITs Can Withstand Short-Term Inflation Pressures

Fitch Ratings, New York, said it sees limited risks to real estate investment trust credit fundamentals from a transitory inflation-rate increase, but noted prolonged elevated inflation could pressure REITs.

CMBS Delinquency Rate Tumbles

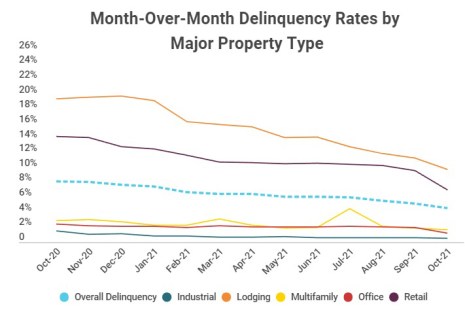

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined sharply again in October.

Housing Market Roundup Nov. 5, 2021: Home Prices Ramp Up; Pressure on Margins; More Affordable Homes Available

Another end to the week; another flurry of economic and housing reports. Here’s a quick summary of what’s come across the MBA NewsLink desk:

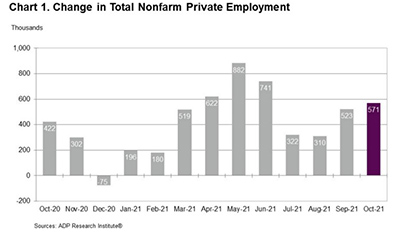

Jobs Reports: October Private-Sector Employment Up by 571,000; the ‘Great Resignation’ Effect on Commercial Estate

In the first of several major reports this week on U.S. employment, ADP, Roseland, N.J., said private-sector employment increased by 571,000 jobs from September to October.