U.S. mortgage performance remains remarkably strong compared to pre-pandemic norms, marked by delinquencies declining on an annual basis, according to ICE Mortgage Technology, Atlanta.

Tag: First Look Mortgage Monitor

ICE First Look: Delinquencies Down in January

Intercontinental Exchange Inc., Atlanta, released its “first look” at mortgage performance, reporting the national delinquency rate dropped to 3.38% in January. That’s the lowest level since October.

Black Knight: Foreclosure Starts Pull Back; Delinquencies Edge Higher

Black Knight, Jacksonville, Fla., said foreclosure starts fell in July and remain well below pre-pandemic levels, while early-stage delinquencies edged up.

Black Knight: Foreclosures at Record Low—But…

Black Knight, Jacksonville, Fla., reported just 0.24 percent of loans in active foreclosure in December, a record low, but cautioned that mortgage delinquency rates remain more than two times pre-pandemic levels.

Black Knight: 1.55 Million Serious Delinquencies Nag Market

Black Knight, Jacksonville, Fla., said the national delinquency rate hit its lowest level since the onset of the pandemic in June and is now back below its pre-Great Recession average. Despite the improvement, more than 1.5 million homeowners remain 90 or more days past due on their mortgages but who are not in foreclosure, still nearly four times pre-pandemic levels.

Black Knight: Past-Due Loans Continue to Improve

Black Knight, Jacksonville, Fla., said the national delinquency rate rose to 4.73% from 4.66% in April, although the increase was driven largely by the three-day Memorial Day weekend foreshortening available payment windows. Overall, it said past-due loan rates continued to improve.

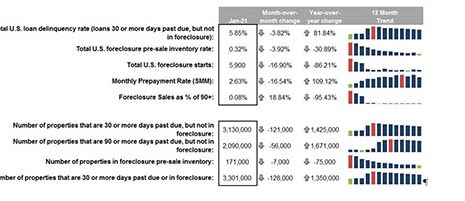

Black Knight: Delinquency Rate Falls Below 5% for First Time Since Pandemic

Black Knight, Jacksonville, Fla., said the national mortgage delinquency rate fell by more than 7 percent in April to below 5 percent for the first time since onset of the coronavirus pandemic.

Housing Market Roundup

Among the many housing reports that came across our desk this week: Genworth Mortgage Insurance said 2020 was the “best year on record” for first-time home buyers; Radian said February home prices accelerated; Black Knight reported mortgage delinquencies rose for the first time in nine months; and Redfin said the home-buying process is becoming a headache for many consumers.

Black Knight: Delinquency Rate Below 6% for First Time in Nearly a Year, Yet 2.1M Homeowners Remain Seriously Delinquent

Black Knight, Jacksonville, Fla., said the national mortgage delinquency rate fell below 6% for the first time since nearly a year, but cautioned some 2.1 million homeowners remain seriously delinquent on their mortgage payments.

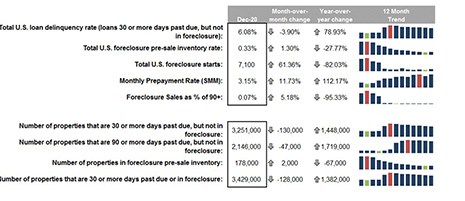

Black Knight First Look: 2020 Ends with Higher Delinquencies, Lower Foreclosures

Black Knight, Jacksonville, Fla., said 2020 ended with 1.54 million more delinquent and 1.7 million more seriously delinquent mortgages than at the start of the year, a looming reminder of the challenges facing the market in 2021.