Black Knight: Delinquency Rate Below 6% for First Time in Nearly a Year, Yet 2.1M Homeowners Remain Seriously Delinquent

(Chart courtesy Black Knight.)

Black Knight, Jacksonville, Fla., said the national mortgage delinquency rate fell below 6% for the first time since nearly a year, but cautioned some 2.1 million homeowners remain seriously delinquent on their mortgage payments.

The company’s monthly First Look Mortgage Monitor said January’s improvement among overall delinquencies to 5.95 percent as well as seriously past due mortgages was nearly identical to the average monthly improvement seen during the recovery to date.

However, the report said while delinquencies continue to improve slowly and steadily, some 2.1 million homeowners remain 90 or more days past due but not yet in foreclosure – still five times pre-pandemic levels.

“Recent forbearance and foreclosure moratorium extensions have reduced near-term risk, but at the same time may have the effect of extending the length of the recovery period,” Black Knight said.

At the current rate of improvement, Black Knight said 1.8 million mortgages will still be seriously delinquent at the end of June, when foreclosure moratoriums on government-backed loans are currently slated to lift

Meanwhile, with widespread moratoria still in place, both foreclosure starts and sales (completions) remained near record lows in January. Prepayment activity fell by 17% month-over-month in January but remains 86% above last year’s levels

Other key January report findings:

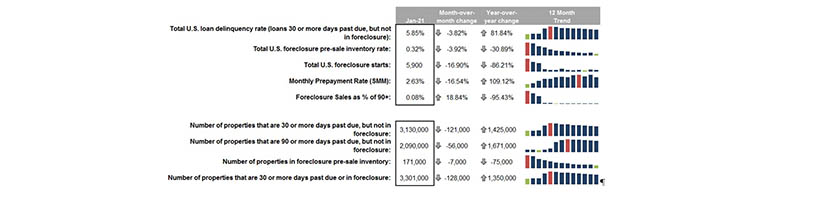

–Total loan delinquency rate (loans 30 or more days past due, but no in foreclosure: 5.85 percent, down by nearly 4 percent from December but up by nearly 82 percent from a year ago.

–Total foreclosure pre-sale inventory rate: 0.32 percent, down by nearly 4 percent from December and down by nearly 31 percent from a year ago.

–Total foreclosure starts: 5,900, down by nearly 17 percent from December and by 86.2 percent from a year ago.

–Monthly prepayment rate: 2.63 percent, down by 16.5 percent from December but up by 109.1 percent from a year ago.

–Properties 30 or more days past due but not in foreclosure: 3.13 million, down by 121,000 from December but up by 1.425 million from a year ago.

–Properties 90 or more days past due but not in foreclosure: 2.09 million, down by 56,000 from December but up by 1.671 million from a year ago.

–Properties in foreclosure pre-sale inventory: 171,000, down by 7,000 from December and down by 75,000 from a year ago.

–Properties 30 or more days past due or in foreclosure: 3.30 million, down by 128,000 from December but up by 1.35 million from a year ago.

–States with the highest percentage of non-current loans: Oklahoma, New York, Hawaii, Louisiana, Mississippi.

–States with the lowest percentage of non-current loans: Idaho, Washington, Colorado, Utah, Oregon

–States with the highest percentage of 90-day plus delinquencies: Mississippi, Louisiana, Hawaii, Nevada, Maryland.