Industry news from Xactus, FHFA, Calque and A&D Mortgage.

Tag: FHFA

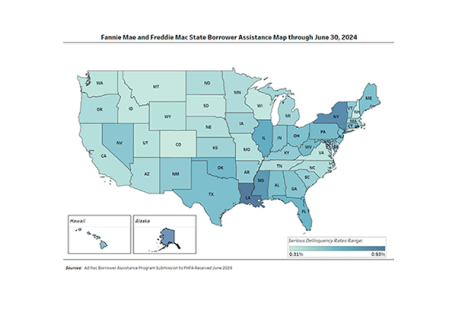

FHFA Reports More Than 7 Million Foreclosure Prevention Actions During GSE Conservatorships

The Federal Housing Finance Agency reported that Fannie Mae and Freddie Mac completed 46,378 foreclosure prevention actions during the second quarter, raising the total number of homeowners who have been helped to 7,004,262 since the start of conservatorships in September 2008.

MBA Statement on FHFA’s Suspended Counterparty Program Re-Proposal

MBA President and CEO Bob Broeksmit, CMB, issued the following statement regarding the Federal Housing Finance Agency’s announced re-proposal of amendments to its Suspended Counterparty Program (SCP) regulation:

FHFA Proposes 2025-2027 Housing Goals for GSEs, Seeks Comments

The Federal Housing Financing Agency last week issued a proposed rule that would establish the 2025-2027 yearly housing goals for Freddie Mac and Fannie Mae.

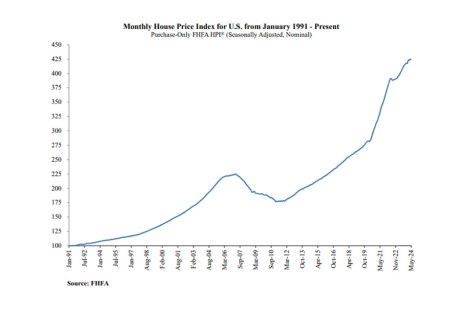

May Indexes Reveal Year-Over-Year Price Gains

The Federal Housing Finance Agency released its seasonally adjusted monthly House Price Index for May, revealing that year-over-year prices were up 5.7%, but flat from April.

MBA Weighs in with FHFA on FHLB Core Mission Activities

The Mortgage Bankers Association submitted a letter yesterday to the Federal Housing Finance Agency regarding its request for information on Federal Home Loan Bank core mission activities.

FHFA Releases NMDB Outstanding Residential Mortgage Statistics

There were 50.8 million outstanding mortgages with unpaid balances totaling $11.7 trillion at the end of the first quarter, the Federal Housing Finance Agency reported Tuesday.

GSEs, FHFA, HUD Implement ROV Requirements–What Lenders Need to Know: ICE’s John Holbrook

In May, Fannie Mae, Freddie Mac and the Federal Housing Finance Agency announced the implementation of new lender requirements for reconsiderations of value, effective Aug. 29. Here’s what lenders should know.

John Holbrook From ICE: GSEs, FHFA, HUD Implement ROV Requirements–What Lenders Need to Know

In May, Fannie Mae, Freddie Mac and the Federal Housing Finance Agency announced the implementation of new lender requirements for reconsiderations of value, effective Aug. 29. Here’s what lenders should know.

ICE’s John Holbrook: GSEs, FHFA, HUD Implement ROV Requirements–What Lenders Need to Know

In May, Fannie Mae, Freddie Mac and the Federal Housing Finance Agency announced the implementation of new lender requirements for reconsiderations of value, effective Aug. 29. Here’s what lenders should know.