May Indexes Reveal Year-Over-Year Price Gains

(Image courtesy of FHFA)

The Federal Housing Finance Agency released its seasonally adjusted monthly House Price Index for May, revealing that year-over-year prices were up 5.7%, but flat from April.

The 0.2% price increase reported in April was revised upward to 0.3%.

“U.S. house price movement was flat in May,” said Anju Vajja, Deputy Director for FHFA’s Division of Research and Statistics. “The slowdown in U.S. house price appreciation continued in May amid a slight rise in both mortgage rates and housing inventory.”

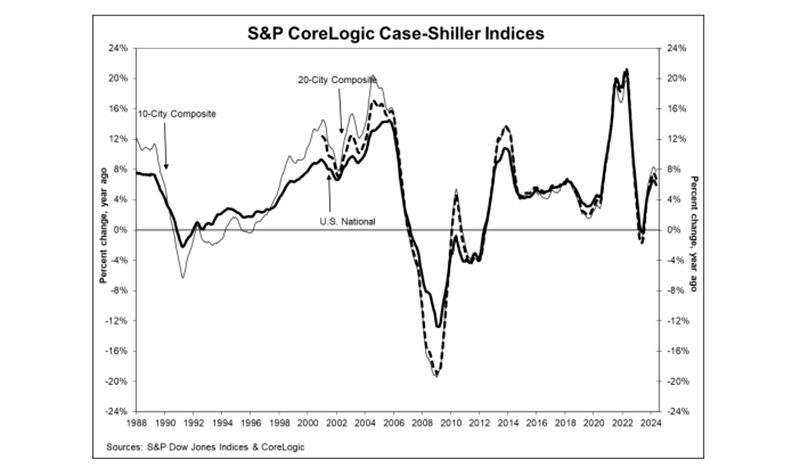

Released the same day, the S&P CoreLogic Case-Shiller Indices reported a 5.9% year-over-year gain in May. That compares with an annual gain of 6.4% in April.

Month-over-month results were a seasonally adjusted increase of 0.3% and a non-seasonally adjusted increase of 0.9%.

The index–after most recently breaking its record in April–again stands at the highest level in its history.

“While annual gains have decelerated recently, this may have more to do with 2023 than 2024, as recent performance remains encouraging,” says Brian Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “Our home price index has appreciated 4.1% year-to-date, the fastest start in two years. Covering the six-month period dating to when mortgage rates peaked, our national index has risen the past four months, erasing the stall experienced late last year.”

“In May, the CoreLogic S&P Case-Shiller Index slowed for the second consecutive month, to a 5.9% year-over-year gain, after peaking at 6.5% in February and March. The slowing of yearly gains continues to reflect a residual comparison with the strong 2023 spring season, while also illustrating the impact of slowing housing demand on cooling price growth,” noted CoreLogic Chief Economist Selma Hepp. “The housing market experienced considerable cooling at the end of the spring home-buying season as mortgage rates pushed beyond the 7% benchmark–which seems to be a mental barrier for potential homebuyers in deciding to enter the home-buying process. June existing home sales activity, reflecting high April mortgage rates, slowed to the lowest since the Great Financial Crisis.”