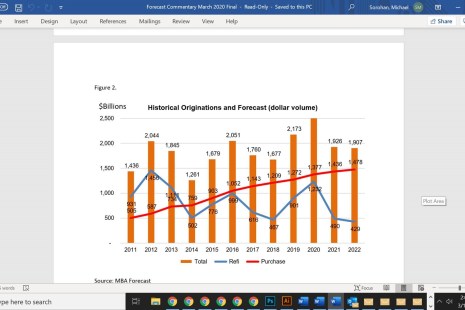

The Mortgage Bankers Association today issued its revised Mortgage Finance Forecast and Economic Forecast, in which MBA doubled its previous 2020 refinance mortgage originations projections.

Tag: Federal Reserve

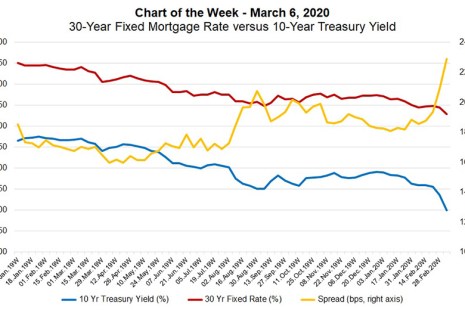

MBA Chart of the Week: 30-Year Fixed Rate vs. 10-Year Treasury

The yield on U.S. 10-year Treasuries fell to record lows last week, driven by increasing concerns regarding the spread of the coronavirus and its impact on the global and U.S. economy. Just last week, there has been an increase in occurrences of business shutdowns, travel restrictions and potential spending reductions.

Fed Cuts Rates Amid Coronavirus Risks

The Federal Reserve yesterday made an emergency cut to the federal funds rate, citing “evolving risks” stemming from the global coronavirus outbreak.

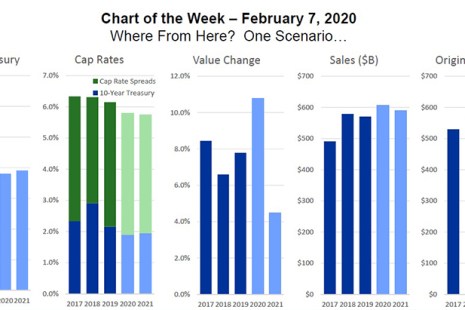

MBA Chart of the Week: Where from Here? One Scenario

On Sunday, we kicked off CREF 2020–MBA’s 2020 Commercial Real Estate Finance/Multifamily Housing Convention & Expo, with an economic and mortgage market update. One of the main messages: the commercial/multifamily markets ended 2019 on a very strong note.

The Week Ahead

SAN DIEGO–For the Mortgage Bankers Association, the action shifts from New Orleans following last week’s Independent Mortgage Bankers Conference, to the west coast for the MBA annual Commercial Real Estate Finance/Multifamily Housing Convention & Expo.

Fed Holds Line on Benchmark Rates

The Federal Open Market Committee, anticipating no dramatic changes to the U.S. economy in the near future, concluded its two-day policy meeting yesterday with no action on key interest rates.

Fed Holds Line on Benchmark Rates

The Federal Open Market Committee, anticipating no dramatic changes to the U.S. economy in the near future, concluded its two-day policy meeting yesterday with no action on key interest rates.

December Report Caps Solid Year of Jobs, Wage Growth

Total nonfarm payroll employment rose by 145,000 in December, slightly lower than previous months, the Bureau of Labor Statistics reported Friday.

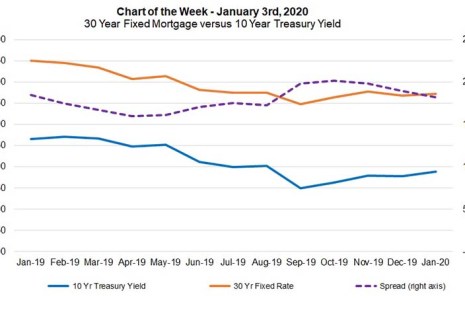

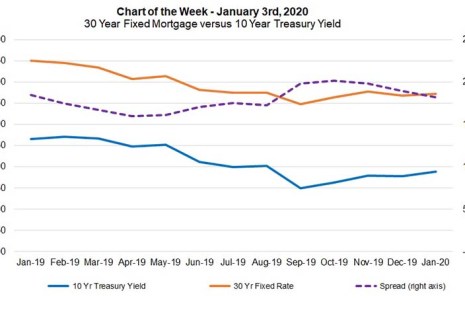

MBA Chart of the Week: 30-Year Fixed Mortgage vs. 10-Year Treasuries

This week’s chart shows the narrowing of the spread between the 30-year fixed mortgage rate and the 10-year Treasury yield–from a high of 208 basis points in September to 183 basis points at the end of December.

MBA Chart of the Week: 30-Year Fixed Mortgage vs. 10-Year Treasuries

This week’s chart shows the narrowing of the spread between the 30-year fixed mortgage rate and the 10-year Treasury yield–from a high of 208 basis points in September to 183 basis points at the end of December.