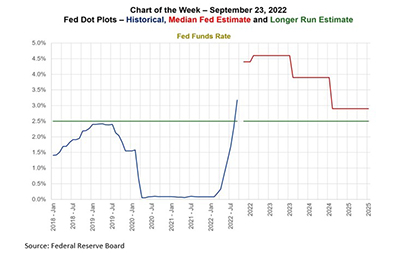

In response to inflation continuing to run well above its target of 2%, the Federal Reserve this week again raised the federal funds target by 75 basis points. Now at 3%, the rate above what most FOMC members consider to be the long-term level and should be effective in reducing demand and slowing inflation over time.

Tag: Federal Reserve

MBA Letter to Agencies Targets Topline CRA Issues

The Mortgage Bankers Association last week sent a letter to federal regulatory agencies, discussing several topline issues it says are crucial to improving the current Community Reinvestment Act framework.

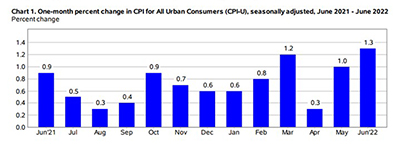

Soaring Gas, Food Prices Drive June Consumer Price Index to 40-Year High

Broad-based increases in major price categories, particularly gas and food, drove the U.S. Consumer Price Index up by 1.3 percent in June month over month and by 9.1 percent year over year—the largest annual increase since 1981, the Bureau of Labor Statistics reported Wednesday.

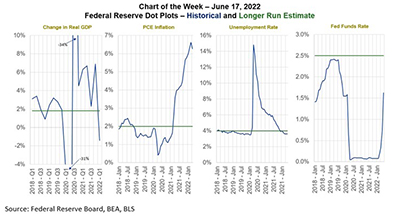

MBA Chart of the Week June 17 2022: Federal Reserve Projections

The Federal Reserve is racing to catch up to economic events, announcing a 75-basis-point increase in the federal funds rate and signaling more increases following last week’s FOMC meeting.

Federal Reserve Raises Interest Rates 50 Basis Points

The Federal Reserve raised its target range for the federal funds rate by 50 basis points–the largest increase since 2000–on Wednesday.

Federal Reserve Raises Interest Rates 50 Basis Points

The Federal Reserve raised its target range for the federal funds rate by 50 basis points–the largest increase since 2000–on Wednesday.

The Week Ahead Jan. 10, 2022: Six Things to Know

Good morning and Happy Monday! Here are six things to know this week:

Industry Briefs Dec. 8, 2021: Agencies Announce Dollar Thresholds for Exempt Consumer Credit/Lease Transactions

The Federal Reserve Board and the Consumer Financial Protection Bureau announced the dollar thresholds used to determine whether certain consumer credit and lease transactions in 2022 are exempt from Regulation Z (Truth in Lending) and Regulation M (Consumer Leasing).

Worried about Tapering? Chris Bennett Says ‘Relax’

It’s not often the mortgage industry plays coy when it comes to certain topics, but currently, there are rumblings about the T-word – tapering. There’s a couple of misconceptions about tapering and what that might mean, especially for mortgages and mortgage-backed securities. Let’s clear those up.

Worried about Tapering? Chris Bennett Says ‘Relax’

It’s not often the mortgage industry plays coy when it comes to certain topics, but currently, there are rumblings about the T-word – tapering. There’s a couple of misconceptions about tapering and what that might mean, especially for mortgages and mortgage-backed securities. Let’s clear those up.