The Federal Reserve cut interest rates by 50 basis points Sept. 18.

Tag: Federal Reserve

MBA Economist Mike Fratantoni on Jerome Powell’s Remarks Indicating Cuts

Federal Reserve Chair Jerome Powell spoke Aug. 23 at an economic symposium sponsored by the Federal Reserve Bank of Kansas City, in Jackson Hole, Wyo. His remarks implied the likelihood of near-term rate cuts.

Fed Holds Rates Steady Again

The Federal Reserve again held rates steady July 31, noting that there has been “some further progress toward the Committee’s 2% inflation objective” over the past few months.

Fed Holds Rates Steady

The Federal Reserve held rates steady Wednesday and now projects only one rate cut in 2024.

Fed Holds Rates Unchanged May 1

The Federal Reserve held rates steady at its meeting ended May 1, as data regarding the strength of the economy and stubbornly high inflation have resulted in a shift in the timing of any rate cuts.

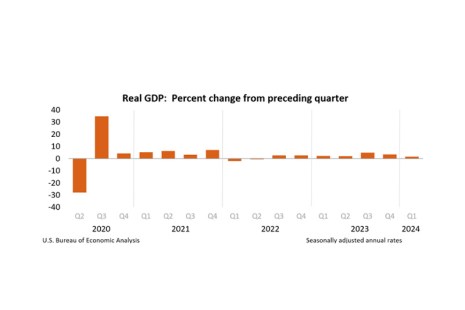

GDP Grew at 1.6% in Q1; Industry Economists Weigh In

Real gross domestic product increased at an annual rate of 1.6% in the first quarter, per the advance estimate released by the Bureau of Economic Analysis.

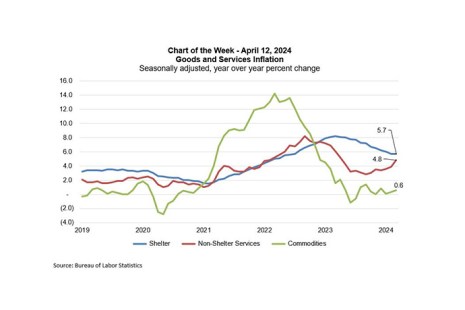

MBA Chart of the Week: Goods and Services Inflation

The week’s news has been around the Consumer Price Index (CPI) release showing that inflation was hotter than expected in March, which is likely to delay the Federal Reserve’s first rate cut in 2024 and contributed to a significant spike in the 10-year Treasury yield to over 4.5%.

Fed Holds Rates Steady

The Federal Open Market Committee held rates steady on Wednesday, stating that “the risks to achieving its employment and inflation goals are moving into better balance”

MBA Continues to Cite ‘Substantial Concerns’ in Basel III NPR Comments

Following a joint comment letter with other trade groups submitted last week, the Mortgage Bankers Association also outlined more in depth concerns about the Notice of Proposed Rulemaking regarding the implementation of the final components of the Basel III standards in a separate letter Tuesday.

To the Point With Bob: Proposed Capital Requirements on Big Banks Would Mean Fewer Choices, Higher Mortgage Costs

MBA President and CEO Bob Broeksmit, CMB, provides his perspective on the latest proposed capital requirement developments and their effects on the industry.