Annual Home Prices Fall for 7th Consecutive Month

Reports from S&P Down Jones Indices, New York, and the Federal Housing Finance Agency, Washington, D.C., saw home prices fall on an annual basis for the seventh consecutive month.

The S&P CoreLogic Case-Shiller National Home Price NSA Index reported a 3.8% annual gain in January, down from 5.6% in December. The 10-City Composite annual increase came in at 2.5%, down from 4.4% in December. The 20-City Composite posted a 2.5% year-over-year gain, down from 4.6% in the previous month.

Miami led the 20-City Index with a 13.8% year-over-year price increase, followed by Tampa at 10.5% and Atlanta at 8.4%. All 20 cities reported lower prices in the year ending January 2023 versus the year ending December 2022.

Month over month, before seasonal adjustment, the National Index posted an -0.5% decrease in January, while the 10-City and 20-City Composites posted decreases of -0.5% and -0.6%, respectively. After seasonal adjustment, the U.S. National Index posted a month-over-month decrease of -0.2%, while both the 10-City and 20-City Composites posted decreases of -0.4%. Before seasonal adjustment, 19 cities reported declines with only Miami reporting an increase at 0.1%. After seasonal adjustment, 15 cities reported declines while Miami, Boston, Charlotte, and Cleveland had slight increases.

“January’s market weakness was broadly based,” said Craig J. Lazzara, Managing Director with S&P DJI. “Financial news this month has been dominated by ructions in the commercial banking industry, as some institutions’ risk management functions proved unequal to the rising level of interest rates. Despite this, the Federal Reserve remains focused on its inflation-reduction targets, which suggest that rates may remain elevated in the near-term. Mortgage financing and the prospect of economic weakness are therefore likely to remain a headwind for housing prices for at least the next several months.”

Following the housing market freefall at the end of the year, the decline in mortgage rates in December and early January spurred some much-needed optimism for the housing market. In response to lower rates, home sales posted strong monthly gains in January and February, suggesting that pent-up buyer demand is eagerly responding to mortgage rate movements,” said CoreLogic Chief Economist Selma Hepp, Irvine, Calif. “Given the mortgage investor market response since Fed’s March meeting, home price growth may surprise to the upside if mortgage rates remain favorable, especially in light of continued supply constraints. But, ongoing volatility in mortgage rates and fallout from the banking crisis could put a damper on spring home-buying season, particularly if credit tightening impacts mortgage availability and consumer confidence takes another hit.”

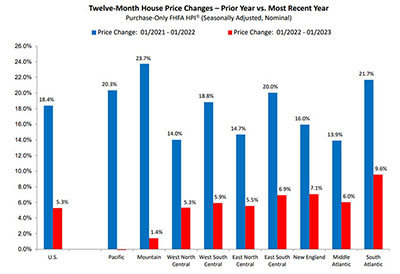

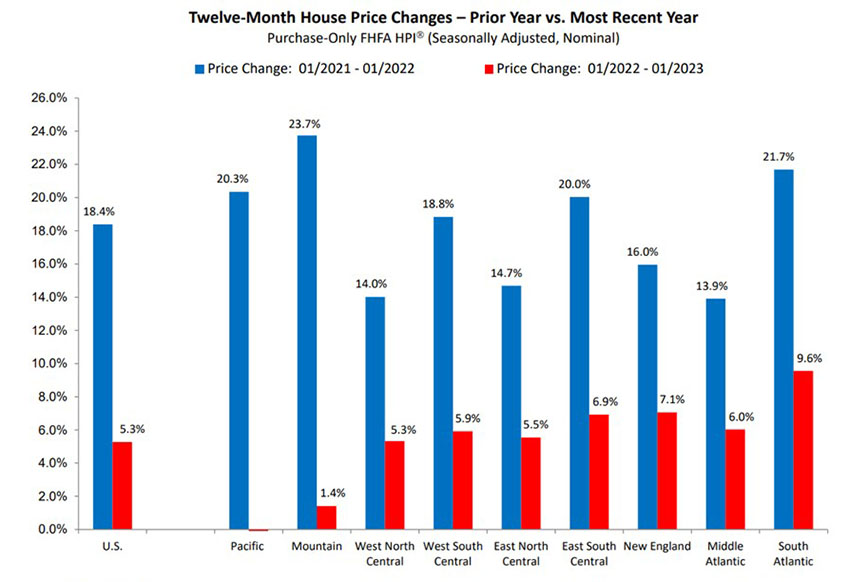

In a separate report, the FHFA House Price Index showed house prices rose by 0.2 percent in January from December, and slowed to 5.3 percent annually.

For the nine census divisions, seasonally adjusted monthly price changes from December 2022 to January 2023 ranged from -0.6 percent in the Pacific division to +2.0 percent in the New England division. The 12-month changes were -1.5 percent in the Pacific division to +9.6 percent in the South Atlantic division.

“U.S. house prices changed slightly in January, continuing the trend of the last few months,” said Dr. Nataliya Polkovnichenko, Supervisory Economist in FHFA’s Division of Research and Statistics. “Many of the January closings, on which this month’s HPI is constructed, reflect rate locks after mortgage rates declined from their peak in early November. Inventories of available homes for sale remained low.”