The Federal Housing Finance Agency announced updates to its implementation plan for the GSEs’ adoption of FICO 10T and VantageScore 4.0 and bi-merge reporting requirements. Mortgage Bankers Association President and CEO Bob Broeksmit, CMB, issued the following comments.

Tag: Federal Housing Finance Agency

MBA Comments on FHFA’s Credit Scoring Implementation Plan

The Federal Housing Finance Agency yesterday announced updates to its implementation plan for the GSEs’ adoption of FICO 10T and VantageScore 4.0 and bi-merge reporting requirements. Mortgage Bankers Association President and CEO Bob Broeksmit, CMB, issued the following comments.

FHFA Releases Fannie Mae, Freddie Mac Stress Tests

The Federal Housing Finance Agency on Thursday released the results of its Fannie Mae and Freddie Mac Dodd-Frank Act Stress Tests.

FHFA Releases Fannie Mae, Freddie Mac Stress Tests

The Federal Housing Finance Agency on Thursday released the results of its Fannie Mae and Freddie Mac Dodd-Frank Act Stress Tests.

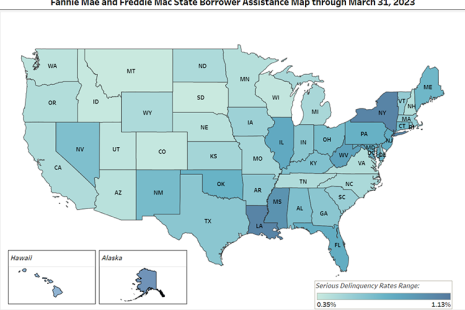

FHFA: More Than 6.7M Troubled Homeowners Helped During Conservatorships

Fannie Mae and Freddie Mac completed 58,268 foreclosure prevention actions in the first quarter, the Federal Housing Finance Agency reported Friday.

FHFA Issues 2022 Report to Congress

The Federal Housing Finance Agency released its 2022 Report to Congress Thursday.

#MBASecondary23: A Look Ahead at Government Lending

NEW YORK–Leaders of FHA, the Federal Housing Finance Agency and Ginnie Mae shared recent developments and their outlook for future policies and activities here at the Mortgage Bankers Association’s National Secondary Market Conference & Expo.

#MBASecondary23: How the FHLBs are Evolving in a Changing Market

NEW YORK–Not everyone can become a member of the Federal Home Loan Bank System—just ask most independent mortgage banks.

Seth Sprague, CMB, of Richey May: Now’s the Time to Prepare for FHFA/Ginnie Mae Rules Changes for Non-Bank Servicers

On August 17, 2022, the Federal Housing Finance Agency and Ginnie Mae jointly announced updated minimum financial eligibility and capital rules for seller/servicers and issuers. These changes update the capital and financial eligibility requirements for non-bank servicers that have been modified over the past year. Understanding the new requirements is critical for seller/servicers and issuers to maintain compliance; however, these changes also raise potential strategic and operational challenges in the future.

Industry Briefs May 16, 2023: FHFA Requests Input on GSEs’ Single-Family Pricing Framework

LenderLogix, Buffalo, N.Y., announced its streamlined point-of-sale LiteSpeed now offers a Spanish version of the residential loan application to support communication with Spanish-speaking borrowers in their native language.