The Mortgage Bankers Association on Monday asked for a meeting with Treasury and Federal Housing Finance Agency officials to address MBA member concerns over newly imposed limits on government-sponsored enterprise operations that could cause potential disruptions to the housing finance system.

Tag: Federal Housing Finance Agency

MBA Urges Treasury, FHFA to Reconsider GSE Purchase Caps

The Mortgage Bankers Association on Monday asked for a meeting with Treasury and Federal Housing Finance Agency officials to address MBA member concerns over newly imposed limits on government-sponsored enterprise operations that could cause potential disruptions to the housing finance system.

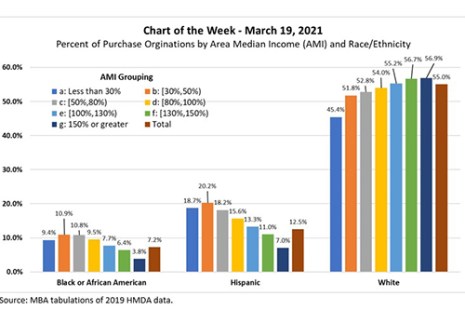

MBA Chart of the Week: Percent of Originations by Median Income, Race/Ethnicity

We analyzed the 2019 Home Mortgage Disclosure Act data for the 30 largest metropolitan statistical areas to understand the distributions of first lien mortgage purchase originations by Area Median Income and by race/ethnicity.

Industry Briefs Mar. 12, 2021

HUD approved a Conciliation Agreement between JPMorgan Chase Bank and a Black woman, resolving the woman’s claim that the mortgage lender, relying on an appraisal that she believed was inaccurate, valued her home at an amount lower than its actual worth because of her race.

MBA Letters Address GSE Liquidity Requirements, ‘Living Wills’

The first letter offers recommendations on how FHFA can improve its framework for codifying new liquidity requirements for Fannie Mae and Freddie Mac. The second letter addresses an FHFA proposal to require Fannie and Freddie to develop and maintain “living wills” in the event one or both of them becomes insolvent.

MBA Letters Address GSE Liquidity Requirements, ‘Living Wills’

The first letter offers recommendations on how FHFA can improve its framework for codifying new liquidity requirements for Fannie Mae and Freddie Mac. The second letter addresses an FHFA proposal to require Fannie and Freddie to develop and maintain “living wills” in the event one or both of them becomes insolvent.

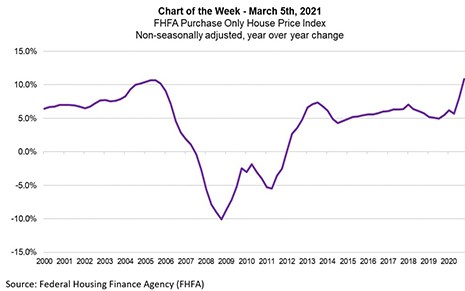

MBA Chart of the Week Mar. 5 2021: FHFA Purchase-Only Index

The rate of U.S. home-price appreciation continues to be driven higher by a combination of strong demand for housing and record-low housing inventory for sale. The Federal Housing Finance Agency’s most recent release showed the fourth quarter saw annual home-price growth of 10.9 percent –the strongest annual change on record. The previous high was an increase of 10.7 percent in third quarter 2005.

FHFA Extends COVID-19 Multifamily Forbearance through June 30

The Federal Housing Finance Agency announced yesterday that Fannie Mae and Freddie Mac will continue to offer COVID-19 forbearance to qualifying multifamily property owners through June 30, subject to the continued tenant protections FHFA imposed during the pandemic. The programs were set to expire March 31.

Industry Briefs Mar. 3, 2021

Equifax, Atlanta, launched its Ignite Lost Sales Analysis platform, which leverages the Equifax cloud to provide the differentiated data, actionable insights and clear visualizations lenders need during prospecting, origination and portfolio retention.

MBA Letter to FHFA Offers Recommendations on Appraisal Policies

The Mortgage Bankers Association, in a Feb. 26 letter to the Federal Housing Finance Agency, offered a set of recommendations aimed at promoting and modernizing the appraisal process.