The Federal Housing Finance Agency published the 2022-2024 Underserved Markets Plans for Fannie Mae and Freddie Mac under the Duty to Serve Program., which outline the government-sponsored enterprises’ commitment to serving manufactured housing, affordable housing preservation and rural housing.

Tag: Federal Housing Finance Agency

MBA Sends FHFA Recommendations on GSE Seller/Servicer Eligibility Requirements

The Mortgage Bankers Association on Monday sent a letter to the Federal Housing Finance Agency, offering detailed recommendations on the agency’s re-proposal of eligibility requirements for seller/servicers of single-family loans backed by Fannie Mae and Freddie Mac.

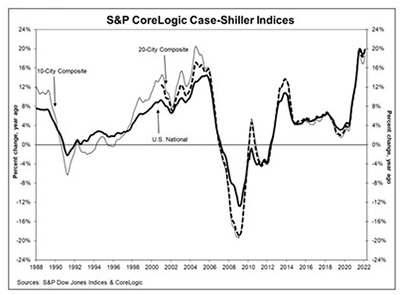

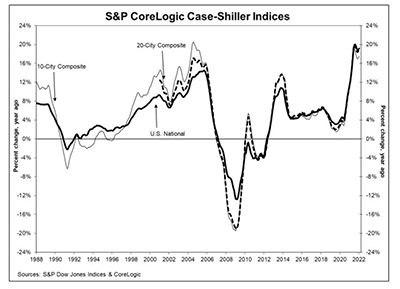

Home Price Indices Flirt with 20% Annual Rate

The S&P CoreLogic Case-Shiller Indices showed annual home price appreciation at 19.8 percent; the Federal Housing Finance Agency House Price Index reported annual appreciation at 19.4 percent.

MBA Sends FHFA Recommendations on GSE Seller/Servicer Eligibility Requirements

The Mortgage Bankers Association on Monday sent a letter to the Federal Housing Finance Agency, offering detailed recommendations on the agency’s re-proposal of eligibility requirements for seller/servicers of single-family loans backed by Fannie Mae and Freddie Mac.

The FHFA 2022-2026 Strategic Plan: What It Means for MBA Members

The Federal Housing Finance Agency last week released its 2022-2026 Strategic Plan for Fiscals Years 2022-2026, focusing guiding Fannie Mae, Freddie Mac and the Federal Home Loan Bank System for the next five years.

FHFA Issues 2022-2026 Strategic Plan

The Federal Housing Finance Agency, Washington, D.C., released its 2022-2026 Strategic Plan Thursday.

The FHFA Foreclosure Suspension for Borrowers Applying for Relief through Homeowner Assistance Fund; Implications for Servicers

Pete Mills, Senior Vice President of Residential Policy and Member Services with the Mortgage Bankers Association, cautioned that the policy could have unintended consequences for mortgage servicers.

FHFA Suspends Foreclosure for Borrowers Applying for Relief through Homeowner Assistance Fund

The Federal Housing Finance Agency on Wednesday said Fannie Mae and Freddie Mac will require servicers to suspend foreclosure activities for up to 60 days if the servicer has been notified that a borrower has applied for assistance under the Department of the Treasury’s Homeowner Assistance Fund.

FHFA Suspends Foreclosure for Borrowers Applying for Relief through Homeowner Assistance Fund

The Federal Housing Finance Agency on Wednesday said Fannie Mae and Freddie Mac will require servicers to suspend foreclosure activities for up to 60 days if the servicer has been notified that a borrower has applied for assistance under the Department of the Treasury’s Homeowner Assistance Fund.

Home Price Appreciation Shows Few Signs of Easing

If home price appreciation is supposed to ease up this year, it’s showing no such signs so far.