MBA Sends FHFA Recommendations on GSE Seller/Servicer Eligibility Requirements

The Mortgage Bankers Association on Monday sent a letter to the Federal Housing Finance Agency, offering detailed recommendations on the agency’s re-proposal of eligibility requirements for seller/servicers of single-family loans backed by Fannie Mae and Freddie Mac.

The proposal features an increase in base liquidity requirements for servicers, as had been contemplated previously by FHFA, as well as by Ginnie Mae and state regulators, while also introducing new liquidity requirements based on the size of an institution’s servicing portfolio and its TBA hedging position.

MBA President and CEO Robert Broeksmit, CMB, noted while FHFA provides its rationale for each of these elements, their combination would result in a higher liquidity requirement by a factor of two to five times for many servicers. “This is a staggering increase in minimum liquidity. FHFA has not provided sufficient rationale as to why such a substantial increase in aggregate liquidity is needed across the sector,” he said.

The letter emphasized any regulatory or quasi-regulatory framework (such as Enterprise eligibility requirements) must be tailored appropriately to the risks presented in the market. “MBA acknowledges the importance of ensuring resiliency among servicers of Enterprise-backed loans, and while the adjustments to net worth and capital requirements appear reasonable, there are critical refinements to the liquidity elements of the proposal that FHFA should address before adopting these requirements.

MBA said the three most important of these refinements relate to:

1) the substantial increase in required (aggregate) liquidity for most servicers;

2) the problematic incentives created by the origination liquidity (to-be-announced (TBA) hedging) requirement; and

3) the lack of recognition of committed lines of credit as stable sources of liquidity.

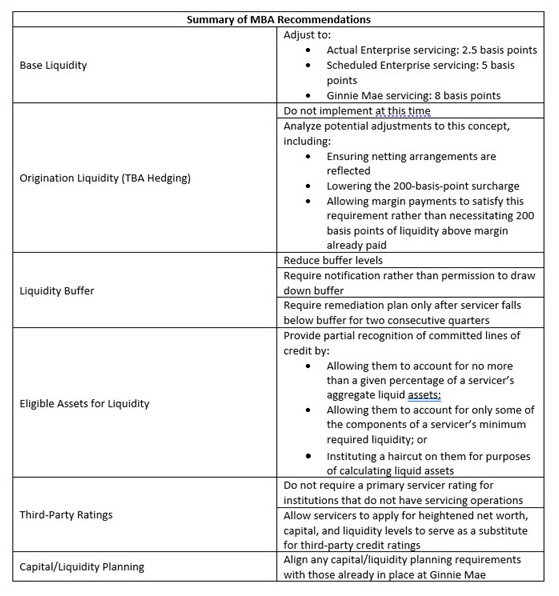

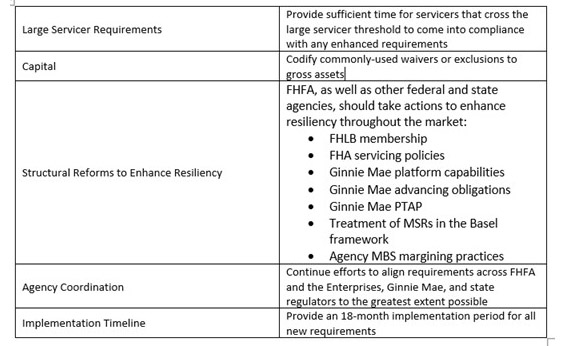

A summary of MBA recommendations appears below:

“Without proper calibration of these requirements, unintended consequences likely would include more institutions selling loans only through the cash window rather than an MBS execution, shifts in volume away from the Enterprises or Ginnie Mae for reasons that are not determined by market conditions and potential consolidation in the industry, resulting in fewer choices and higher costs for borrowers,” the letter said. “Proper calibration of these requirements, on the other hand, will promote resiliency in the market and broad, sustainable access to credit for consumers. MBA looks forward to the ongoing collaboration to achieve this result.”