The Federal Housing Finance Agency, citing “recent market events,” announced it will re-propose updated minimum financial eligibility requirements for Fannie Mae and Freddie Mac Seller/Servicers.

Tag: Fannie Mae

Dealmaker: Hunt Real Estate Capital Provides $67M In Fannie Mae, Freddie Mac Funds

Hunt Real Estate Capital, New York, provided $67 million in Fannie Mae and Freddie Mac funds for four apartment properties in the southeastern U.S. Hunt closed three Fannie Mae multifamily …

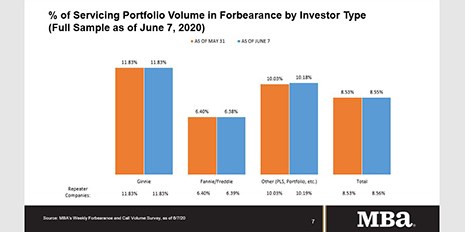

MBA: Share of Mortgage Loans in Forbearance Levels Out at 8.55%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey said loans now in forbearance increased just slightly, to 8.55% of servicers’ portfolio volume as of June 7 compared to 8.53% the prior week. MBA now estimates 4.3 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Levels Out at 8.55%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey said loans now in forbearance increased just slightly, to 8.55% of servicers’ portfolio volume as of June 7 compared to 8.53% the prior week. MBA now estimates 4.3 million homeowners are in forbearance plans.

Industry Briefs

Stewart Information Services Corp., Houston, acquired United States Appraisals. Stewart said the acquisition strengthens its digital real estate services offering in appraisal and valuation management and enhances its existing title insurance, settlement services, appraisal/valuation and other real estate services.

Fannie Mae: Lenders’ Demand Expectations for Purchase Mortgages Down ‘Significantly;’ Refis ‘Strong and Stable’

The latest Fannie Mae Mortgage Lender Sentiment Survey found mortgage lenders’ profit margin outlook for the next three months fell slightly but remained positive due to strong reported refinance demand.

FHFA Extends GSE COVID-Related Loan Processing Flexibilities Through July

The Federal Housing Finance Agency extended several loan origination flexibilities currently offered by Fannie Mae and Freddie Mac designed to help borrowers during the COVID-19 national emergency through at least July 31.

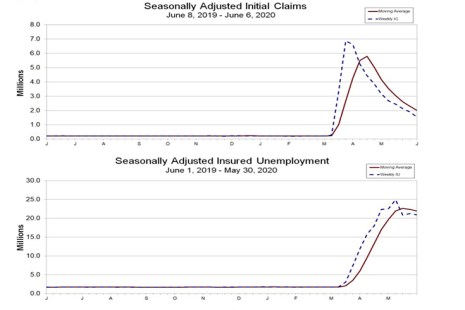

Americans File 1.54 Million More Initial Claims

More than 1.5 million Americans filed new claims for unemployment insurance during the first week of June, the Labor Department reported Thursday—the lowest level since the start of the coronavirus pandemic but still well above historic norms.

Dealmaker: Gantry Arranges $75M in Financing

Gantry Inc., San Francisco, arranged $74.8 million in five transactions in Washington, Arizona and California.

Commercial/Multifamily Briefs June 11, 2020

Eastern Union, New York, hired 75 new brokers for its new quarter-point fee for refinancing multifamily properties backed by Fannie Mae or Freddie Mac.