New home sales beat expectations again in June, HUD and the Census Bureau reported Friday, posting double-digit increases for the second straight month.

Tag: Fannie Mae

Fannie Mae: Explore How the Industry is Going Digital with eMortgages (July 24, 2020)

eMortgages have grown significantly – and in light of recent events, demand is higher than ever. Henry Cason, SVP and Head of Digital Products at Fannie Mae, shares how the industry is embracing digital mortgage solutions. Read our attached blog post for more information.

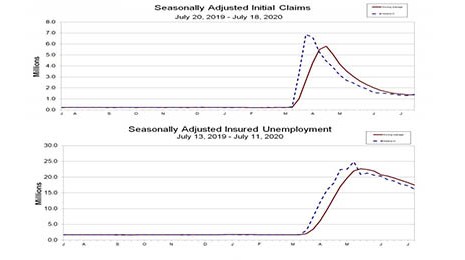

After Several Months of Declines, Insurance Claims Tick Up

Since hitting a record 6.9 million at the end of March, initial claims have fallen, albeit gradually, for the past 15 weeks. That streak ended last week: the Labor Department reported 1.4 million new claims for the week ending July 14, up by 109,000 from the previous week.

Fannie Mae: Explore How the Industry is Going Digital with eMortgages (July 24, 2020)

eMortgages have grown significantly – and in light of recent events, demand is higher than ever. Henry Cason, SVP and Head of Digital Products at Fannie Mae, shares how the industry is embracing digital mortgage solutions. Read our attached blog post for more information.

Dealmaker: Electra Capital, Avid Realty Partners Acquire Texas Multifamily Property

Avid Realty Partners, New York, and Electra Capital, West Palm Beach, Fla., formed a joint venture and acquired The Pines at Woodcreek Apartments, a 2015-built property totaling 330 units near Houston.

Fannie Mae: Explore How the Industry is Going Digital with eMortgages

eMortgages have grown significantly – and in light of recent events, demand is higher than ever. Henry Cason, SVP and Head of Digital Products at Fannie Mae, shares how the industry is embracing digital mortgage solutions. Read our attached blog post for more information.

Industry Briefs July 22, 2020

Quicken Loans, Detroit, along with Amrock, its electronic closing provider, completed a Remote Online Notarization mortgage closing North Carolina, reportedly the first in the state.

Fannie Mae: Explore How the Industry is Going Digital with eMortgages

eMortgages have grown significantly – and in light of recent events, demand is higher than ever. Henry Cason, SVP and Head of Digital Products at Fannie Mae, shares how the industry is embracing digital mortgage solutions. Read our attached blog post for more information.

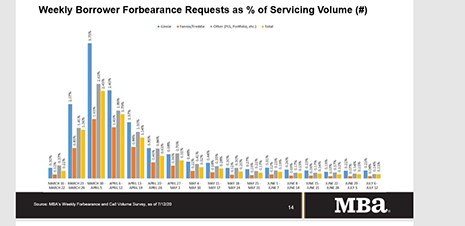

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

FHFA Leaves 2021 GSE Housing Goals Unchanged

With current housing goals set to expire in December, and amid economic uncertainty stemming from the lingering coronavirus pandemic, the Federal Housing Finance Agency yesterday left 2021 housing goals for Fannie Mae and Freddie Mac unchanged from the previous three years.