Fannie Mae, Washington, D.C., said economic growth expectations for full-year 2021 were revised modestly upward to 7.1 percent, one-tenth higher than the previous forecast, due to stronger-than-expected consumer spending data year to date.

Tag: Fannie Mae

May Housing Starts Seesaw Back on Track

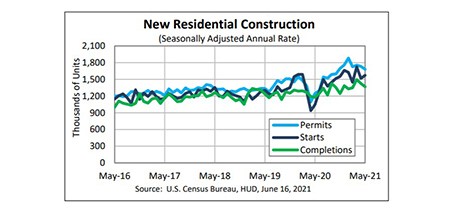

One step back; one step forward. Housing starts have alternated between up and down during 2021, and in keeping with the pattern, improved in May after declining in April, HUD and the Census Bureau reported Wednesday.

Industry Briefs June 15, 2021

The Federal Housing Finance Agency issued a Request for Input on executive compensation at its regulated entities: Fannie Mae and Freddie Mac and the Federal Home Loan Banks.

May Employment Up 559,000; Unemployment Rate Drops to 5.8%

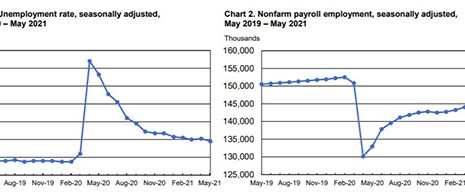

Total nonfarm payroll employment rose by 559,000 in May, the Bureau of Labor Statistics reported Friday—up substantially from May’s tepid numbers but still below consensus expectations, as hiring slowly recovers from the coronavirus pandemic.

FHFA, GSEs Extend COVID-19 Multifamily Forbearance through Sept. 30

The Federal Housing Finance Agency on Thursday said Fannie Mae and Freddie Mac will continue to offer COVID-19 forbearance to qualifying multifamily property owners through September 30.

Industry Briefs June 4, 2021

Zillow, Seattle, said Asian-headed households in the U.S. grew by 83% in the past two decades, far exceeding Latinx, Black, and white household growth. But that broad success masks major challenges to homeownership in the highly diverse community.

New Home Sales Tumble to 10-Month Low

New home sales took a double hit yesterday, according to HUD and the Census Bureau: not only did April new home sales fall by nearly 6 percent, March sales revised sharply downward by more than 10 percent.

Industry Briefs May 21, 2021

Quicken Loans, Detroit, announced it will officially change its name to Rocket Mortgage on July 31. This change will bring alignment to the overall “Rocket” brand.

FHFA Announces GSEs’ Proposed Duty to Serve Underserved Markets Plans for 2022-2024

The Federal Housing Finance Agency published proposed 2022-2024 Underserved Markets Plans submitted by Fannie Mae and Freddie Mac under the Duty to Serve program. The proposed Plans cover the period from January 1, 2022 to December 31, 2024.

Housing Market Roundup: May 20, 2021

Here is a summary of recent housing and housing finance reports.