May Housing Starts Seesaw Back on Track

One step back; one step forward. Housing starts have alternated between up and down during 2021, and in keeping with the pattern, improved in May after declining in April, HUD and the Census Bureau reported Wednesday.

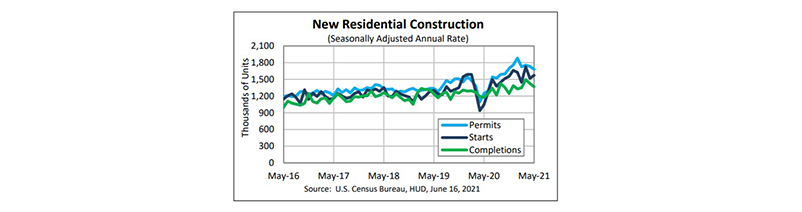

The report said privately owned housing starts in May rose to a seasonally adjusted annual rate of 1,572,000, 3.6 percent higher than the revised April estimate of 1,517,000 and 50.3 percent higher than a year ago (1,046,000). Single‐family housing starts in May improved to 1,098,000, 4.2 percent higher than the revised April figure of 1,054,000. The May rate for units in buildings with five units or more rose to 465,000, up by 4 percent from April (447,000) and up by 52.5 percent from a year ago (305,000).

Regionally, results were mixed, but every region showed high double-digit annual improvement. In the largest region, the South, starts rose by 3.8 percent in May to 814,000 units, seasonally annually adjusted, from 784,000 units in April; from a year ago, starts jumped by nearly 60 percent. In the West, starts rose by just 1 percent to 591,000 units in May from 575,000 units in April but improved by nearly 25 percent from a year ago. In the Midwest, starts jumped by nearly 30 percent to 239,000 units in May from 184,000 units in April and jumped by 66 percent from a year ago.

Only the Northeast saw a monthly decline in housing starts, falling by 22.4 percent in May to 118,000 units, seasonally annually adjusted, from 152,000 units in April; from a year ago, starts in the Northeast jumped by 80 percent.

“Housing starts increased 3.6 percent in May, providing a slight reprieve for a housing market that is experiencing extremely low levels of inventory,” said Joel Kan, Associate Vice President of Economic and Industry Forecasting with the Mortgage Bankers Association. “The 50 percent year-over-year increase was relative to May 2020, when pandemic-related uncertainty and shutdowns halted most building activity.”

“With brisk house price appreciation and a continued lack of existing home sale listings, demand for new construction remains robust,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C. “However, homebuilders continue to face supply constraints, namely shortages of building materials, labor and buildable lots. Despite single-family starts trending modestly downward in recent months, the total number of homes under construction moved up 1.2 percent in May, the twelfth consecutive monthly increase and its highest level since 2007. This divergence likely reflects in part a longer timeline for construction due to supply disruptions. However, with lumber prices falling in recent weeks and a strong backlog of homes sold-but-not-yet-started, we expect some upward movement in single-family starts in the coming months as delayed and put-off projects are initiated.”

“Builders want to build, but as [Tuesday’s] decline in builder sentiment showed, they have some concerns,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “Even as builders have adopted price escalation clauses to cover any price increases that could occur during building due to supply-side limitations, there are concerns that higher new home prices could cause some would-be buyers to pull back from the market. Builders face a shortage of labor, materials and lots, not to mention burdensome and costly regulations that make it difficult to build. These are headwinds to increasing the pace of new home construction that is necessary to alleviate the supply shortages in today’s housing market.”

Charlie Dougherty, economist with Wells Fargo Securities, Charlotte, N.C., said with COVID risks subsiding and job growth ramping up, apartment and condo demand should continue to improve. “The long-awaited return to the office is starting to get under way, which will provide a boost to hard-hit urban markets, such as New York City and San Francisco,” he said. “That said, rising building material prices are also a limitation for new multifamily development.”

Building Permits

The report said privately owned housing units authorized by building permits in May fell to a seasonally adjusted annual rate of 1,681,000, 3 percent below the revised April rate of 1,733,000, but 34.9 percent above a year ago (1,246,000). Single‐family authorizations in May fell to 1,130,000, 1.6 percent below the revised April figure of 1,148,000. Authorizations of units in buildings with five units or more fell to 494,000 in May, down by 7.7 percent in April (535,000 units) but up by 10 percent from a year ago.

“The homebuilding industry continues to grapple with increasing materials costs and delayed deliveries from suppliers,” Kan said.

Housing Completions

Privately owned housing completions in May fell to a seasonally adjusted annual rate of 1,368,000, 4.1 percent below the revised April estimate of 1,426,000, but 16.1 percent higher than a year ago (1,178,000). Single‐family housing completions in May fell to 978,000, 2.6 percent below the revised April rate of 1,004,000. The May rate for units in buildings with five units or more fell to 387,000, down by 7.6 percent from April but up by 18 percent from a year ago.