Fannie Mae, Washington, D.C., revised its full-year 2021 real GDP growth forecast modestly downward due in part to the expectation that COVID-related disruptions to consumer spending and supply chains will more greatly hinder economic activity in the second half of the year than previously forecast.

Tag: Fannie Mae

FHFA Raises Proposed 2022-2024 Housing Goals for Fannie Mae, Freddie Mac

Fannie Mae and Freddie Mac have new homework assignments from the Federal Housing Finance Agency, which raise the stakes considerably for the government-sponsored enterprises’ 2022-2024 affordable housing goals.

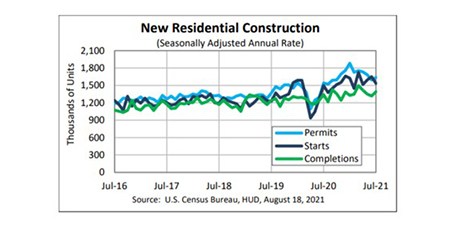

July Housing Starts Fall 7%

July housing starts fell by 7 percent, the Census Bureau reported yesterday, a disappointing result as home builders continue to be hamstrung by pipeline and labor shortages.

FHFA Raises Proposed 2022-2024 Housing Goals for Fannie Mae, Freddie Mac

Fannie Mae and Freddie Mac have new homework assignments from the Federal Housing Finance Agency, which raise the stakes considerably for the government-sponsored enterprises’ 2022-2024 affordable housing goals.

Industry Briefs Aug. 17, 2021

The Federal Housing Finance Agency released reports providing the results of the 2020 and 2021 annual stress tests Fannie Mae and Freddie Mac under the Dodd-Frank Act.

Commercial/Multifamily Briefs from Reonomy, Fannie Mae

Data firm Reonomy, New York, expanded its Market Glance insights to 30 metropolitan statistical areas across Multifamily, Office, Retail, Industrial and Hospitality categories.

MBA: GSE Compensation Should be Sufficient to Attract Best Talent

The most important asset Fannie Mae, Freddie Mac and the Federal Home Loan Banks have is their human capital, so their compensation must be sufficient to attract and retain top talent, the Mortgage Bankers Association said in a letter to the Federal Housing Finance Agency Tuesday.

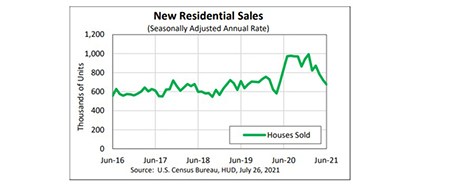

June New Home Sales Down 6.6%

June new home sales fell well below consensus expectations, HUD and the Census Bureau reported Monday, though analysts did not appear to be too worried by the results.

MBA MAA ‘Call to Action’ on GSE ‘G-Fees’

The Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, issued a ‘Call to Action’ on Monday to its 70,000-plus members urging them to tell their elected officials to not use government-sponsored enterprise guaranty fees (g-fees) as a source of funding offsets.

MBA, Trade Groups Reiterate Opposition to G-Fee Offsets

Fresh off of last week’s regulatory victory in which the Federal Housing Finance Agency withdrew its controversial adverse market refinance fee, the Mortgage Bankers Association and several dozen industry trade groups took fresh aim at another controversial practice—a move in Congress to use the government-sponsored enterprises’ guaranty fees—known as “g-fees”—to offset funding for non-housing programs.