MBA, Trade Groups Reiterate Opposition to G-Fee Offsets

Fresh off of last week’s regulatory victory in which the Federal Housing Finance Agency withdrew its controversial adverse market refinance fee, the Mortgage Bankers Association and several dozen industry trade groups took fresh aim at another controversial practice—a move in Congress to use the government-sponsored enterprises’ guaranty fees—known as “g-fees”—to offset funding for non-housing programs.

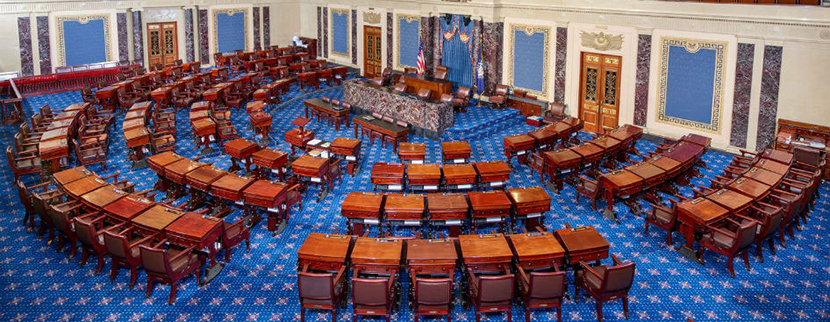

In a July 22 letter to Sens. Kyrsten Sinema, D-Ariz., and Rob Portman, R-Ohio—key players in negotiations over the infrastructure package–MBA and the trade groups urged negotiators to ensure that g-fees would not be used as funding offsets.

“As representatives of institutions that span the entire housing finance ecosystem, we firmly believe that g-fees should only be used as originally intended: as a critical risk management tool to protect against potential mortgage credit losses and to support the GSEs’ charter duties,” the letter said.

It’s a point of contention that MBA and others in the real estate finance industry have had to fight on a yearly basis ever since the g-fees were first implemented in 2008. In 2011, Congress approved a 10-point basis point increase in the g-fees—over the strong objections of MBA and others—to fund a two-month period of payroll tax relief. Since then, MBA and other have repeatedly turned back efforts in Congress to redirect g-fees. But with the 10-year span of the g-fee increase set to expire this year, the letter aims to head off fresh efforts in Congress to redirect g-fees.

“That [2011] increase harmed homebuyers by raising the cost of homeownership in all parts of the country – and continues to do so during the provision’s decade-long lifespan, which expires in September,” the letter said. “Since then, whenever Congress or the Administration has considered using g-fees to cover the cost of non-housing-related programs, our organizations have united to emphatically let lawmakers know that homeowners cannot, and must not, be used as the nation’s ‘piggybank.’ We are united again to reaffirm our opposition to the Congress’s potential use of these fees for any funding offset that may be contemplated.”

The letter noted g-fees are a critical risk management tool used by the GSEs to cover operating costs and losses that occur in their operations. “Increasing g-fees for other purposes effectively taxes potential homebuyers, as well as existing homeowners seeking to refinance their mortgages,” it said. “It is important to note that g-fees are included within the cost structure of all mortgages, including those for first-time homebuyers, veterans and rural communities.”

The letter emphasized given today’s housing affordability and supply constraints, lawmakers must avoid taking any steps that could exacerbate affordability challenges, which could in turn have negative consequences for the broader economy.

“The unintended effects of any proposed g-fee increase or extension will be to raise the cost of homeownership for all Americans, and low- to moderate-income and underserved individuals in particular,” the letter said. “In addition, it would curtail refinance activity that helps to keep creditworthy borrowers in their homes. Moreover, implementing yet another g-fee increase will hinder policymakers’ abilities to execute the necessary reforms required of the GSEs in the years ahead.”

Using g-fees as a funding mechanism is “wholly inappropriate and shifts the burden of paying for infrastructure-related initiatives to the country’s current and future homeowners,” the letter added. “The benefits of affordable homeownership accrue to families, communities, and our national economy; we simply cannot allow these benefits to be jeopardized by efforts to raise g-fees unnecessarily.”

Joining MBA in the letter:

American Bankers Association

American Land Title Association

Asian Real Estate Association of America

CCIM Institute

Community Home Lenders Association

Community Mortgage Lenders of America

Consumer Federation of America

Council for Affordable and Rural Housing

Credit Union National Association

Housing Policy Council

Independent Community Bankers of America

Institute of Real Estate Management

Leading Builders of America

Manufactured Housing Institute

National Apartment Association

National Association of Federally Insured Credit Unions

National Association of Hispanic Real Estate Professionals

National Association of Home Builders

National Association of Realtors

National Council of State Housing Agencies

National Housing Conference

National Multifamily Housing Council

U.S. Mortgage Insurers