On Tuesday, following months of MBA advocacy, the Treasury Department and FHFA suspended certain limits on the business activities of the GSEs. On Wednesday, FHFA also announced a Notice of Proposed Rulemaking to amend the Enterprise Regulatory Capital Framework Rule.

Tag: Fannie Mae

FHFA Issues Proposed Rulemaking to Amend GSE Regulatory Capital Framework

It’s been a busy week for the Federal Housing Finance Agency. On Tuesday, FHFA and the Treasury Department suspended certain provisions added to the Preferred Stock Purchase Agreements with Fannie Mae and Freddie Mac. On Wednesday, FHFA announced a notice of proposed rulemaking to amend the Enterprise Regulatory Capital Framework for Fannie Mae and Freddie Mac.

FHFA Issues Proposed Rulemaking to Amend GSE Regulatory Capital Framework

It’s been a busy week for the Federal Housing Finance Agency. On Tuesday, FHFA and the Treasury Department suspended certain provisions added to the Preferred Stock Purchase Agreements with Fannie Mae and Freddie Mac. On Wednesday, FHFA announced a notice of proposed rulemaking to amend the Enterprise Regulatory Capital Framework for Fannie Mae and Freddie Mac.

FHFA, Treasury Suspend Portions of GSE 2021 Preferred Stock Purchase Agreements

The Federal Housing Finance Agency and the Treasury Department on Tuesday suspended certain provisions added to the Preferred Stock Purchase Agreements with Fannie Mae and Freddie Mac in January.

Fannie Mae: Consumers More Optimistic About Homebuying Conditions for First Time in 6 Months

The Fannie Mae Home Purchase Sentiment Index was largely unchanged in August, decreasing 0.1 points to 75.7, as survey respondents tempered both their recent pessimism about homebuying conditions and their upward expectations of home price growth.

Industry Briefs Sept. 10, 2021: Accurate Group Gets Novacap Investment

Accurate Group, Cleveland, Ohio, a provider of technology-driven real estate appraisal, title data, analytics, and e-closing platforms, entered into a partnership with Novacap, Montreal, a Canadian private equity firm.

FHFA Announces Equitable Housing Finance Plans for GSEs

The Federal Housing Finance Agency announced Tuesday that Fannie Mae and Freddie Mac will submit Equitable Housing Finance Plans by the end of 2021.

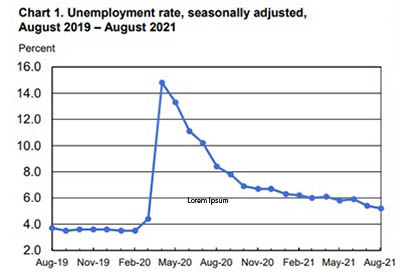

Employers Add 235,000 August Jobs

U.S. employers added 235,000 jobs in August—considerably below July’s massive 1.05 million job gain—as the economy struggled to hold momentum amid rising Delta variant coronavirus cases, the Bureau of Labor Statistics reported Friday.

Administration Announces Steps to Increase Affordable Housing Supply

The Biden Administration on Wednesday announced a number of steps aimed at creating, preserving and selling to homeowners and non-profits nearly 100,000 additional affordable homes for homeowners and renters over the next three years, with an emphasis on the lower and middle segments of the market.

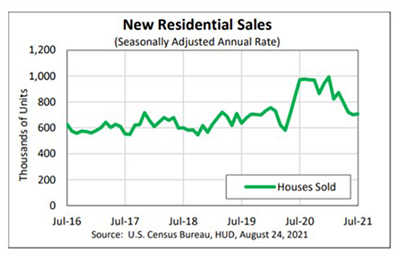

July New Home Sales Post 1% Increase

New single‐family home sales posted a modest 1 percent increase in July amid more signs of a stabilizing housing market, HUD and the Census Bureau reported Tuesday.