ICE Mortgage Technology, Pleasanton, Calif., announced the Colorado Housing and Finance Authority integrated Encompass Investor Connect and AIQ into its technology, enabling faster and easier loan delivery and funding.

Tag: Fannie Mae

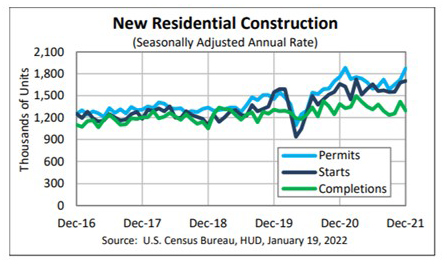

Housing Starts End Year on Positive Note

Housing starts posted a modest increase in December, HUD and the Census Bureau reported Wednesday, and jumped by nearly 16 percent from a year ago.

Dealmaker: Merchants Capital Secures $141M for Washington Mixed-Use Development

Merchants Capital, Carmel, Ind., secured more than $141 million in financing for Waterfront Station II, a mixed-income mixed-use property currently under construction in Washington, D.C.

Industry Briefs Jan. 18, 2022: First American Acquires Mother Lode Holding Co.

First American Financial Corp., Santa Ana, Calif., signed an agreement for its acquisition of Mother Lode Holding Co., a California-based provider of title insurance, underwriting and escrow services for residential and commercial real estate transactions with 17 operating subsidiaries throughout the U.S., including its principal subsidiary Placer Title Co.

Industry Briefs Jan. 10, 2022: Covius Integrates with Stavvy on RON Signing for Loss Mitigation Clients

Covius, Denver, integrated Stavvy into its loss mitigation and loan modification platforms. Stavvy is a Boston-based fintech company specializing in eClosing functionality and remote online notary services.

FHFA Targets Increases to GSE Pricing Framework; Upfront Loan-Level Pricing Adjustments Take Effect Apr. 1

The Federal Housing Finance Agency on Wednesday announced targeted increases to Fannie Mae and Freddie Mac’s upfront fees for certain high-balance loans and second-home loans, effective Apr. 1.

FHFA Targets Increases to GSE Pricing Framework; Upfront Loan-Level Pricing Adjustments Take Effect Apr. 1

The Federal Housing Finance Agency on Wednesday announced targeted increases to Fannie Mae and Freddie Mac’s upfront fees for certain high-balance loans and second-home loans, effective Apr. 1.

FHFA Targets Increases to GSE Pricing Framework; Upfront Loan-Level Pricing Adjustments Take Effect Apr. 1

The Federal Housing Finance Agency on Wednesday announced targeted increases to Fannie Mae and Freddie Mac’s upfront fees for certain high-balance loans and second-home loans, effective Apr. 1.

FHFA Finalizes 2022-2024 Single-Family, 2022 Multifamily Housing Goals

The Federal Housing Finance Agency released benchmark levels for Fannie Mae and Freddie Mac single-family housing goals for 2022 through 2024 and benchmark levels for multifamily housing goals for 2022.

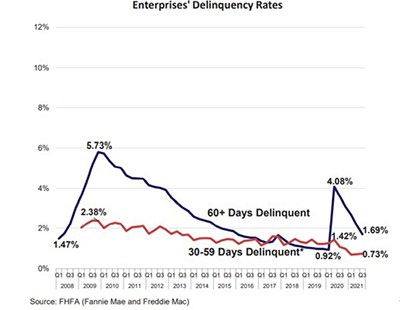

FHFA: GSE Delinquency Rate Falls to 1.55%

The Federal Housing Finance Agency released its third quarter Foreclosure Prevention and Refinance Report, showing Fannie Mae and Freddie Mac completed 180,566 foreclosure prevention actions during the quarter, raising the total number of homeowners who have been helped to 6,210,485 since the start of conservatorships in September 2008.