2022 GSE Conforming Loan Limits Rise 18.5% to $647,200

Conforming loan limits for Fannie Mae and Freddie Mac will rise to $647,200 jump in 2022, the Federal Housing Finance Agency said on Tuesday—a jump of nearly $100,000 from 2021’s previous record high.

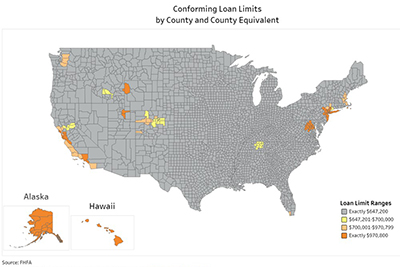

FHFA said the conforming loan limit will rise in all but four U.S. counties. For most of the U.S. the 2022 CLL for one-unit properties will be $647,200, an increase of $98,950 18.5%) from 2021. While 95 percent of U.S. counties will be subject to the new baseline limit of $647,200, nearly 100 counties will have conforming loan limits approaching $1 million.

“FHFA is actively evaluating the relationship between house price growth and conforming loan limits, particularly as they relate to creating affordable and sustainable homeownership opportunities across all communities,” said FHFA Acting Director Sandra Thompson.

“FHFA has raised the conforming loan limits, as prescribed under HERA, to reflect the rise in the average U.S. home price,” said Mortgage Bankers Association President & CEO Robert Broeksmit, CMB. “Over the last 18 months, housing prices have significantly increased due to record low inventory levels amidst strong demand. The higher loan limits reflect this dynamic.”

For areas in which 115 percent of the local median home value exceeds the baseline conforming loan limit, the applicable loan limit will be higher than the baseline loan limit. The Housing and Economic Recovery Act establishes the high-cost area limit in those areas as a multiple of the area median home value, while setting a “ceiling” at 150 percent of the baseline limit. Median home values generally increased in high-cost areas in 2021, which increased their CLL. The new ceiling loan limit for one-unit properties will be $970,800, which is 150 percent of $647,200.

Special statutory provisions establish different loan limits for Alaska, Hawaii, Guam, and the U.S. Virgin Islands. In these areas, the baseline loan limit will be $970,800 for one-unit properties.

HERA requires that the baseline CLL for the Enterprises be adjusted each year to reflect the change in the average U.S. home price. Also on Tuesday, FHFA published its third quarter House Price Index report, which includes statistics for the increase in the average U.S. home value over the past four quarters. According to the nominal, seasonally adjusted, expanded-data FHFA HPI, house prices increased by 18.05 percent, on average, between the third quarters of 2020 and 2021, thus establishing the baseline CLL for 2022 will increase by the same percentage.

Other Resources

- List of 2022 conforming loan limits for all counties and county-equivalent areas in the U.S.

- A map showing the 2022 conforming loan limits across the U.S.

- Detailed addendum of the methodology used to determine the conforming loan limits.

- List of FAQs that covers broader topics that may be related to CLLs.

- Questions about the 2022 CLLs can be addressed to LoanLimitQuestions@fhfa.gov. For more information, visit https://www.fhfa.gov/CLLs.