Fannie Mae in its Home Price Index found single-family home prices were up 3% in the second quarter from the same period in 2022.

Tag: Fannie Mae

Fannie Mae, Redfin Find Home Prices Are Up

Fannie Mae in its Home Price Index found single-family home prices were up 3% in the second quarter from the same period in 2022.

Fannie Mae, Redfin Find Home Prices Are Up

Fannie Mae in its Home Price Index found single-family home prices were up 3% in the second quarter from the same period in 2022.

Fannie Mae, Redfin Find Home Prices Are Up

Fannie Mae in its Home Price Index found single-family home prices were up 3% in the second quarter from the same period in 2022.

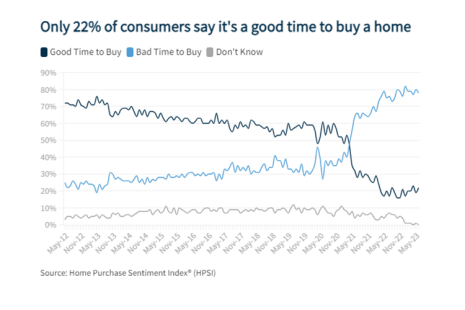

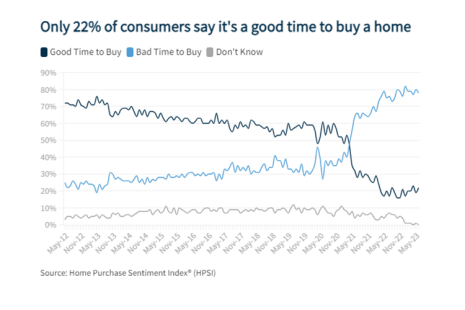

Fannie Mae: Consumer Confidence in Housing Flat in June

Fannie Mae released its Home Purchase Sentiment Index for June, notching an only 0.4 point increase to 66 as supply and economic constraints continue to weigh heavily on American homebuying.

Fannie Mae: Consumer Confidence in Housing Flat in June

Fannie Mae released its Home Purchase Sentiment Index for June, notching an only 0.4 point increase to 66 as supply and economic constraints continue to weigh heavily on American homebuying.

Industry Briefs June 29, 2023

Industry Briefs from Fannie Mae, Floify, Truv, Mobility Market Intelligence and Lender ToolKit.

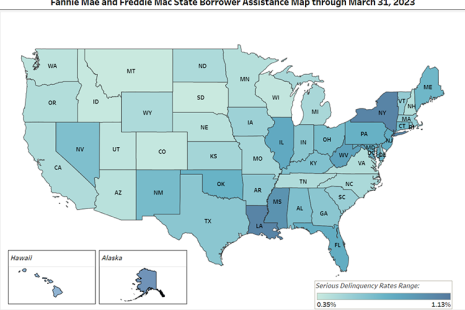

FHFA: More Than 6.7M Troubled Homeowners Helped During Conservatorships

Fannie Mae and Freddie Mac completed 58,268 foreclosure prevention actions in the first quarter, the Federal Housing Finance Agency reported Friday.

Matt Stepanovich of SingleSource Property Solutions: The ABCs of Appraisal Modernization

Matt Stepanovich serves as Vice President, Appraisal Modernization & Quality Control for SingleSource Property Solutions, where he oversees the company’s appraisal modernization initiatives.

Owning a Home Still Important in Vision of ‘Good Life,’ Survey Says

Aspirations to homeownership remain high, despite rising interest rates and home prices.