Fannie Mae, Redfin Find Home Prices Are Up

(Courtesy Fannie Mae)

Fannie Mae in its Home Price Index found single-family home prices were up 3% in the second quarter from the same period in 2022.

Meanwhile, Redfin, Seattle, found the median U.S. home sale price was up 1.5% from a year earlier during the four weeks ending July 9–that’s the first increase to the metric in nearly 5 months.

Fannie Mae’s Home Price Index jump of 3% is down from the previous quarter’s revised annual growth of 4.9%. On a quarterly basis, home prices were up 1.9% (seasonally adjusted), an increase from 1.3% in the first quarter.

“Once again, home price growth surprised to the upside,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. “Housing demand remains resilient, which continues to butt up against the near-historically limited supply of existing homes for sale. Moreover, the ‘lock-in effect,’ in which homeowners are disincentivized to list their homes for sale because of how high mortgage rates have risen, is seriously inhibiting the supply of existing homes available for sale.”

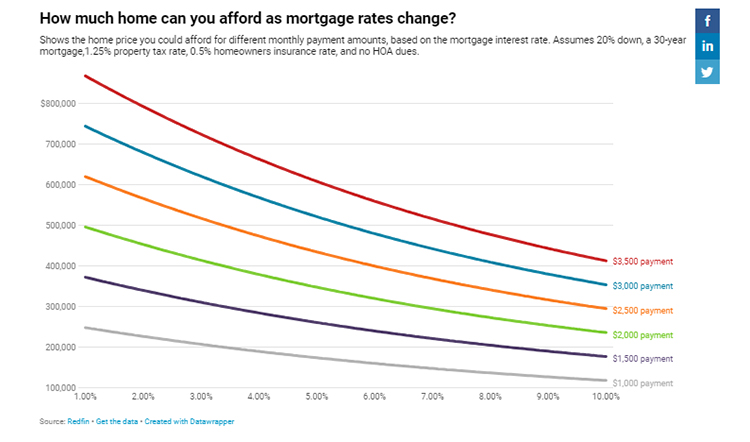

Redfin said in its findings that the elevated prices have pushed the typical homebuyer’s monthly payment to a near-record high of $2,627.

Once again, a lack of supply is pushing prices. New listings are down 27% year-over-year Redfin found, the biggest drop since the beginning of the pandemic. Total homes on the market are down 14%.

However, one bright spot is recent news that inflation is cooling, Redfin said.

“This month’s inflation report is likely to bring mortgage rates down a bit from their recent highs. It shows that the Fed’s interest-rate hikes are working and ups the chance they’ll only hike rates one more time this year,” said Redfin Economic Research Lead Chen Zhao. “Because elevated mortgage rates are responsible for both of today’s major homebuying challenges–high monthly housing payments and low inventory–any decline is welcome news for buyers. But even though rates will come down slightly, they’ll likely remain well above 6% until the Fed sees several more months of inflation readings closer to their target.”