A growing proportion of remote and hybrid workers are willing to live farther from their workplace, reported Fannie Mae, Washington, D.C.

Tag: Fannie Mae

Decoupling Where People Live from Where They Work: Fannie Mae

A growing proportion of remote and hybrid workers are willing to live farther from their workplace, reported Fannie Mae, Washington, D.C.

Fannie Mae: Consumers Still Frustrated by Lack of Housing Affordability

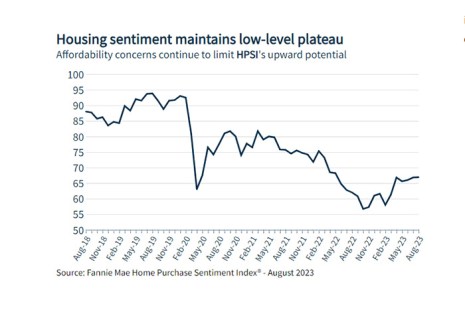

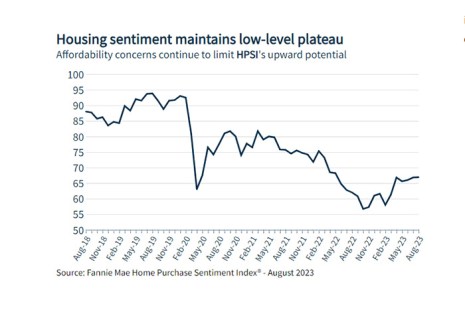

Fannie Mae’s Home Purchase Sentiment Index for August remained fairly flat month-to-month, with consumers continuing to be pessimistic about housing.

Fannie Mae: Consumers Still Frustrated by Lack of Housing Affordability

Fannie Mae’s Home Purchase Sentiment Index for August remained fairly flat month-to-month, with consumers continuing to be pessimistic about housing.

Housing Starts Increase in July

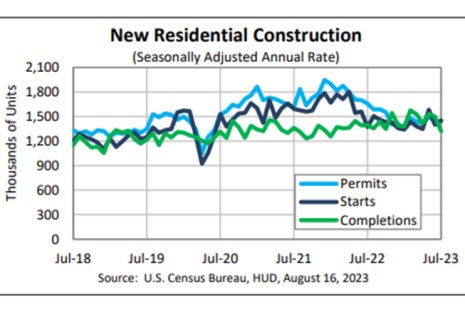

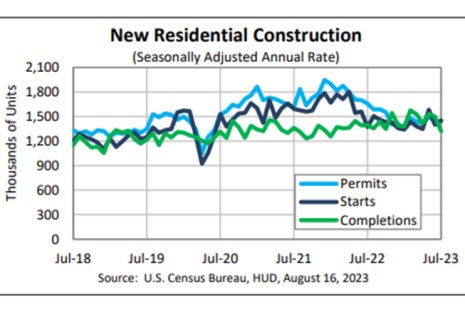

Housing starts in July were at a seasonally adjusted annual rate of 1,452,000, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly announced.

Housing Starts Increase in July

Housing starts in July were at a seasonally adjusted annual rate of 1,452,000, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly announced.

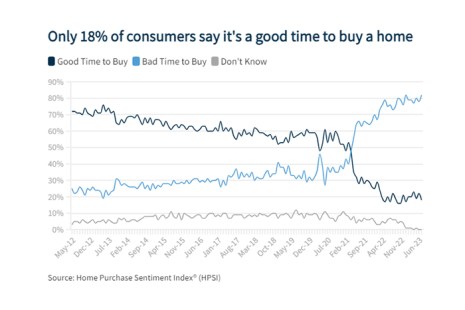

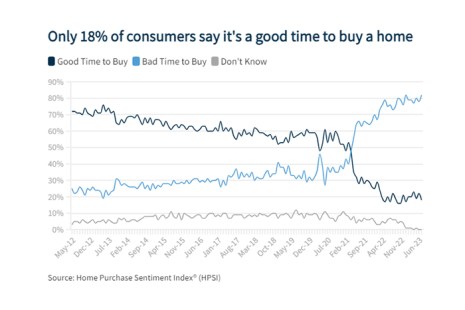

Fannie Mae: Only 18% of Consumers Believe It’s a Good Time to Buy

Fannie Mae’s Home Purchase Sentiment Index increased slightly in July, but 82% of consumers believe it’s “a bad time” to buy a home, a survey high and up from 78% in June.

Fannie Mae: Only 18% of Consumers Believe It’s a Good Time to Buy

Fannie Mae’s Home Purchase Sentiment Index increased slightly in July, but 82% of consumers believe it’s “a bad time” to buy a home, a survey high and up from 78% in June.

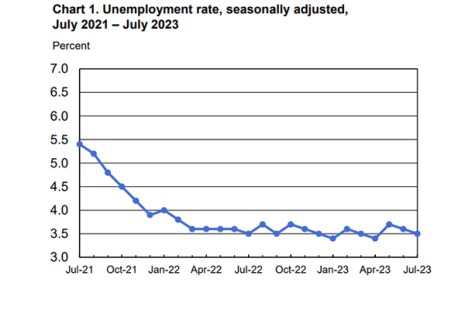

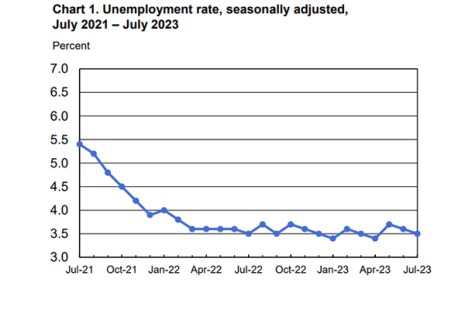

Jobs Up by 187,000; Unemployment Rate Flat in July

Total nonfarm payroll employment was up by 187,000 in July, and the unemployment rate remained fairly flat at 3.5%, the U.S. Bureau of Labor Statistics reported.

Jobs Up by 187,000; Unemployment Rate Flat in July

Total nonfarm payroll employment was up by 187,000 in July, and the unemployment rate remained fairly flat at 3.5%, the U.S. Bureau of Labor Statistics reported.