Fannie Mae: Consumers Still Frustrated by Lack of Housing Affordability

(Image courtesy Fannie Mae)

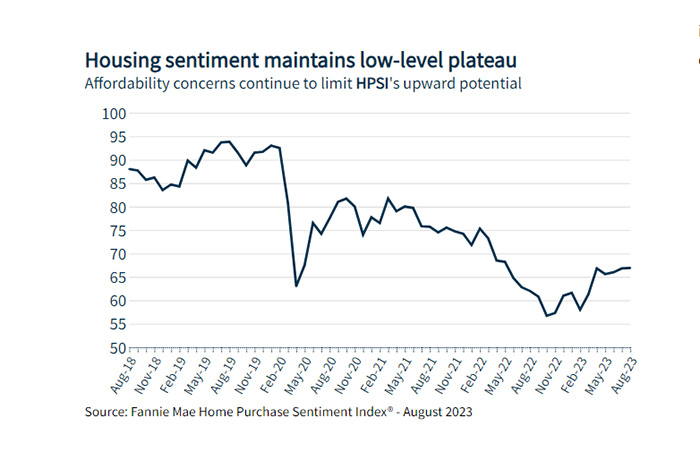

Fannie Mae’s Home Purchase Sentiment Index for August remained fairly flat month-to-month, with consumers continuing to be pessimistic about housing.

The full index is up 4.9 points year over year, but up only 0.1 point from July.

“Consumers remain pessimistic toward the housing market in general and homebuying conditions in particular,” Doug Duncan, Fannie Mae Senior President and Chief Economist, said. “The overall HPSI is maintaining the low-level plateau set a few months back, and we don’t see much upside to the index in the near future, barring significant improvements to home affordability, which we also don’t expect.”

Only 18% of respondents said now is a “good time” to buy a home, flat from July.

However, 66% said now is a “good time” to sell, with the “net good time to sell” metric up 5% month-over-month and 9% year-over-year.

When asked about home prices, 41% believe they’ll go up over the next 12 months, the same number as in July. Eighteen percent of respondents believe mortgage rates will go down, up only slightly from July.

Seventy-eight percent of respondents are not concerned about job loss over the next year, compared with 80% in July. Additionally, 22% report their net income as significantly higher over the past year.

“From a historical perspective, the current housing market is unusual, as demonstrated in part by the HPSI and its recent plateauing,” Duncan continued. “Given the significant home price appreciation and rapid rise in mortgage rates, it is very much a tale of two markets, at least from a consumer perspective. Of course, a third perspective exists among homebuilders, who are currently thriving amid the surge in demand for new home construction, a function of the unusual dynamics at play in the existing home space between would-be sellers and would-be buyers, as well as changing labor market dynamics owing to the ongoing prevalence of remote work.”