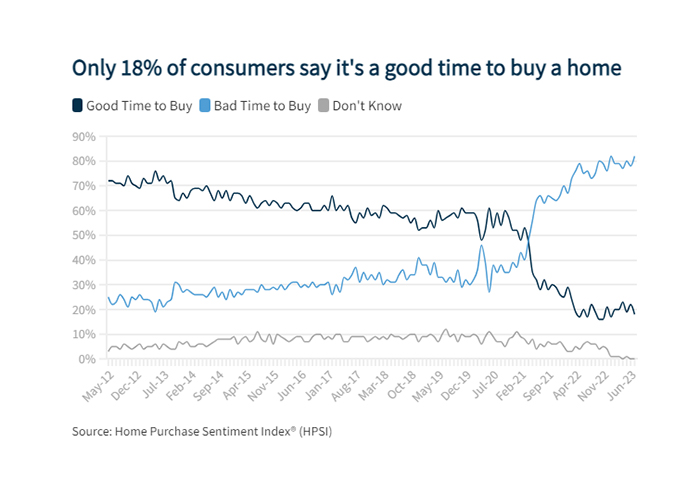

Fannie Mae: Only 18% of Consumers Believe It’s a Good Time to Buy

(Image courtesy Fannie Mae)

Fannie Mae’s Home Purchase Sentiment Index increased slightly in July, but 82% of consumers believe it’s “a bad time” to buy a home, a survey high and up from 78% in June.

Consumers are reporting more confidence in their personal financial situations, but have a sense of pessimism regarding homebuying conditions.

“In July, a significant majority of consumers indicated that their jobs are stable and that their incomes are the same or better than they were 12 months ago,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. “Unsurprisingly, consumers continue to attribute the challenging conditions to high home prices and unfavorable mortgage rates. Further, the share of consumers expecting home prices to continue to rise has also been on a steady climb since March, which may only add to perceptions of unaffordability.”

Duncan also noted that the “good time to sell” metric had not moved much over its past few surveys, which indicates supply issues are likely to continue. In the most recent survey, 64% said it was a “good time to sell.”

Forty-one percent of respondents believe home prices will go up over the next year, and 45% believe mortgage rates will increase over that period.

In terms of the more positive personal financial results, however, only 20% of respondents were concerned about job loss over the next year, and 19% reported significantly higher household income than the past year.