Despite a pullback in late 2025, nearly 45% of mortgaged homes remain equity rich according to ATTOM, Irvine, Calif.

Tag: Equity

ATTOM: Share of Equity-Rich Homes Down in Q3

ATTOM, Irvine, Calif., released its third-quarter 2025 U.S. Home Equity and Underwater Report, finding that 46.1% of mortgaged residential properties were equity-rich.

ICE Mortgage Monitor Finds Some Early Signs of Stress for Homeowners

ICE Mortgage Technology, Atlanta, released its July 2025 Mortgage Monitor report, finding that there are early signs of financial stress emerging among subsets of homeowners.

ICE Mortgage Monitor: Record Levels of Home Equity, Falling Rates Drive Highest HELOC Withdraws Since 2008

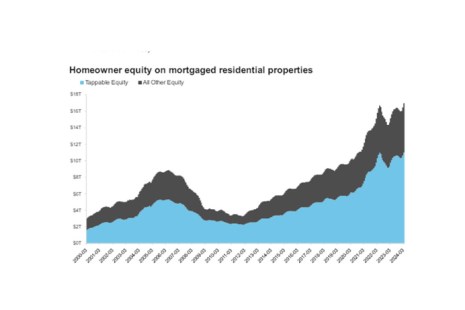

U.S. mortgage holders carried a record $17.6 trillion in home equity entering the second quarter–with $11.5 trillion considered “tappable”–according to ICE Mortgage Technology, Atlanta.

Jobber Projects Home Services Growth Possible in Second-Half 2024

Home service software provider Jobber, Edmonton, Alberta, released its Home Service Economic Report for the second quarter, finding that consumer spending on home services, such as renovations, may grow in the second half of this year.

Homeowner Equity Dips in Q1, ATTOM Finds

ATTOM, Irvine, Calif., released its first-quarter 2024 U.S. Home Equity and Underwater report, revealing 45.8% of mortgaged residential properties in the U.S. are equity-rich.

ICE Mortgage Monitor: Q1 Sees Record Levels of Tappable Equity

Intercontinental Exchange Inc., Atlanta, released its ICE Mortgage Monitor report for May, finding that homeowners with mortgages closed out the first quarter with a record $16.9 trillion in equity–$11 trillion of which was tappable.

FirstClose Survey: Many Consumers Don’t Understand Advantages of Home Equity

FirstClose, Austin, Texas, released a recent survey of homeowners, finding many lack awareness of the advantages of leveraging home equity and other related topics.

ATTOM: Portion of Equity-Rich Homes Dips Slightly in Q4

ATTOM, Irvine, Calif., released its fourth-quarter 2023 U.S. Home Equity & Underwater Report, showing 46.1% of mortgaged residential properties in the U.S. were considered equity-rich, a slight drop from 47.4% in the third quarter.

TD Bank Survey: Homeowners Plan to Tap Into Equity for Renovations

TD Bank, Cherry Hill, N.J., released its HELOC Trend Watch survey, finding that 38% of homeowners who are renovating their properties within the next two years intend to use a home equity line of credit or home equity loan for funds.