ATTOM: Equity-Rich Portion of Mortgaged Homes Slips at Fastest Pace in At Least Four Years

(Illustration courtesy of ATTOM)

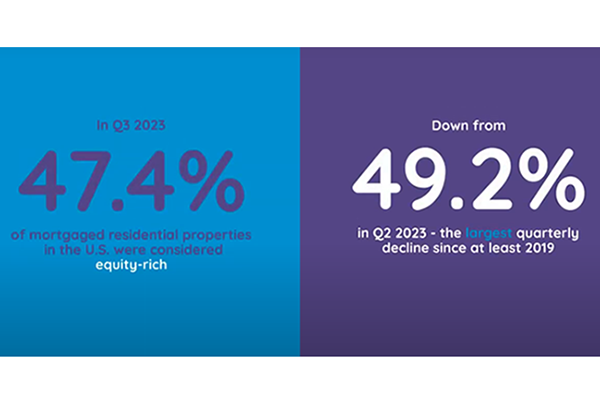

Just over 47% of mortgaged residential properties in the U.S. were considered “equity-rich” in the third quarter, decreased from 49.2% in the second quarter, according to ATTOM, Irvine, Calif.

The drop represents the largest quarterly decline since at least 2019, the ATTOM third-quarter U.S. Home Equity & Underwater Report said.

In this context, “equity-rich” means the combined estimated amount of loan balances secured by those properties was no more than half of their estimated market values.

“The latest figure also was down from 48.5 percent in the third quarter of 2022,” the report said. “Those declines happened despite home values rebounding recently from a fallback that had lasted from the middle of last year to the early part of this year.”

But while equity-rich levels dropped in the third quarter, the report also found that the portion of mortgaged homes that were seriously underwater (a combined estimated balance of loans secured by the property of at least 25 percent more than the property’s estimated market value.) in the U.S. continued to improve.

Just 2.5 percent of all residential mortgages, or one in 40, were considered seriously underwater in the third quarter, ATTOM found. “The seriously underwater level dropped from one in 36 homes in the second quarter and from one in 35 in the third quarter of 2022, to the lowest point in at least four years,” the report said.

ATTOM CEO Rob Barber said homeowner equity around the country remained strong during the third quarter by all measures as millions of households kept benefitting from the nation’s extended runup in home values. “At the same, though, we saw an unusual downturn at the equity-rich end of the spectrum,” he noted. “That could have just been a temporary blip. It also could have reflected an increase in long-time owners who had lots of equity built up selling their homes, or perhaps borrowing against their rising wealth and slipping out of equity rich territory. The fourth quarter data should say more about whether residential equity in the U.S. has indeed topped out.”