Homeowner Equity Improves in Second Quarter

(Courtesy ATTOM)

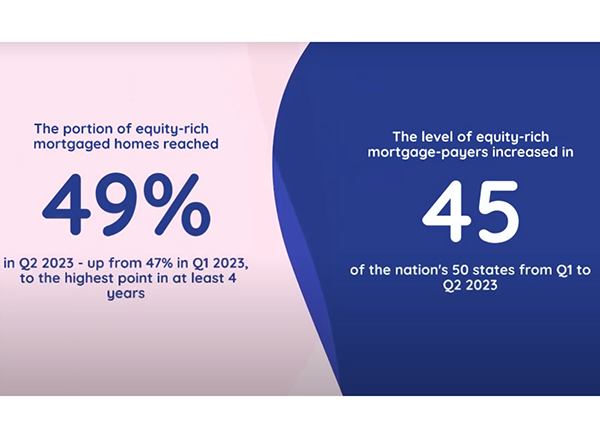

ATTOM, Irvine, Calif., reported nearly half–49%–of mortgaged residential properties in the United States were considered equity-rich in the second quarter, up from 47% in early 2023.

“Equity-rich” means the estimated amount of loan balances secured by those properties was no more than half of their estimated market values.

The firm’s second-quarter U.S. Home Equity & Underwater Report said the equity-rich figure stands at its highest point in at least four years. “With home prices rebounding across the U.S., the level of equity-rich mortgage-payers went up from the first quarter of 2023 to the second quarter of 2023 in 45 of the nation’s 50 states,” the report said.

The gains followed two straight quarterly drop-offs caused by a temporary slowdown in the U.S. housing market that had threatened to end a decade-long run of price and equity growth, ATTOM said. The second-quarter upturn marked another sign of how the market shift has helped homeowners, as home-seller profits also spiked.

“The second-quarter market revival bestowed immediate benefits on homeowners around the nation in the form of better profits for sellers and rising equity for those staying put,” said ATTOM CEO Rob Barber. “Equity levels were high even during the recent downturn, and now they are going back up and better than ever.”

Barber noted the market remains in flux and the recent improvement could easily be temporary. “Lots of changing forces are at work affecting whether boom times are really back, especially amid a recent increase in mortgage rates,” he said. “But with the 2023 peak buying season still underway, it seems that homeowners can reasonably expect their household balance sheets to grow a bit more in the near future.”

The report also found that less than 3 percent of mortgaged homes in the U.S., or one in 36, were considered seriously underwater in the second quarter, meaning they had a combined estimated balance of loans secured by the property of at least 25 percent more than the property’s estimated market value.

ATTOM noted home mortgage rates dipped by one-half to three-quarters of a point for a 30-year fixed loan during the second quarter after more than doubling in 2022 to about 7 percent. At the same time, consumer price inflation dipped down under 4 percent, the stock market improved after a year of ups and downs, and unemployment remained less than 4 percent. That happened as the peak annual buying season revved up during a time when the supply of homes for sales around the U.S. remained historically low.