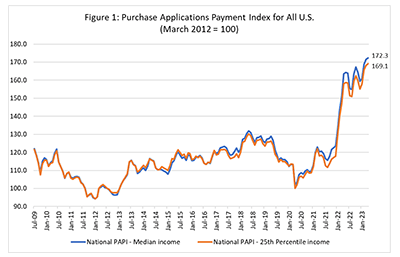

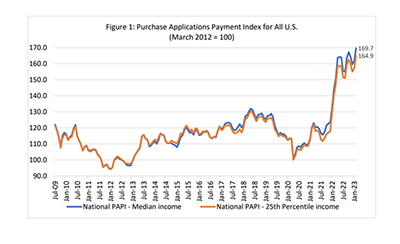

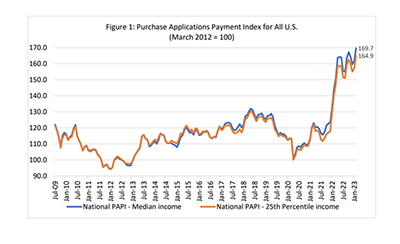

Homebuyer affordability declined further in April, with the national median payment applied for by purchase applicants increasing 0.9 percent to $2,112, the Mortgage Bankers Association’s Purchase Applications Payment Index reported.

Tag: Edward Seiler

MBA: March Mortgage Application Payments Increase 1.6 Percent to Record High

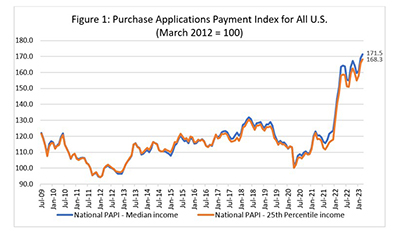

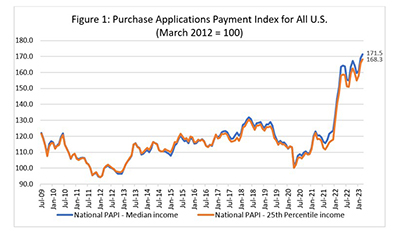

Homebuyer affordability declined in March, with the national median payment applied for by purchase applicants increasing 1.6 percent to $2,093 from $2,061 in February, the Mortgage Bankers Association reported Thursday.

MBA: March Mortgage Application Payments Increase 1.6 Percent to Record High

Homebuyer affordability declined in March, with the national median payment applied for by purchase applicants increasing 1.6 percent to $2,093 from $2,061 in February, the Mortgage Bankers Association reported Thursday.

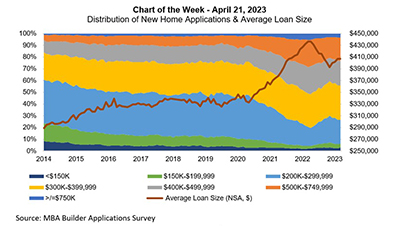

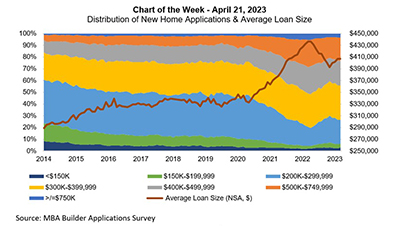

MBA Chart of the Week Apr. 21, 2023–New Home Applications, Average Loan Size

This week’s MBA Chart of the Week delves into builder applications by loan size, to illustrate how the mix of the new home market has changed since 2014.

MBA Chart of the Week Apr. 21, 2023–New Home Applications, Average Loan Size

This week’s MBA Chart of the Week delves into builder applications by loan size, to illustrate how the mix of the new home market has changed since 2014.

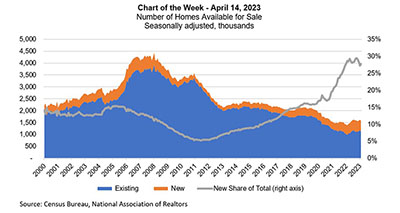

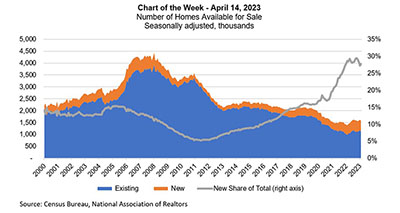

MBA Chart of the Week, Apr. 14, 2023: Number of Homes Available for Sale

MBA’s forecast calls for a gradual recovery in home purchase activity in the second half of 2023, driven by some catch-up buying from 2022 when mortgage rates surged and by younger age cohorts entering homeownership. However, this recovery will be dependent on affordability conditions improving

MBA Chart of the Week, Apr. 14, 2023: Number of Homes Available for Sale

MBA’s forecast calls for a gradual recovery in home purchase activity in the second half of 2023, driven by some catch-up buying from 2022 when mortgage rates surged and by younger age cohorts entering homeownership. However, this recovery will be dependent on affordability conditions improving

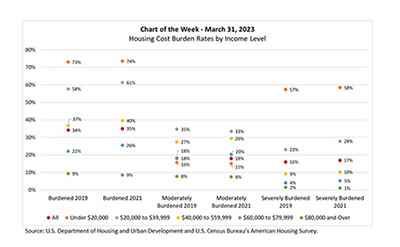

MBA Chart of the Week Mar. 31, 2023: Housing Cost Burden Rates by Income Level

In this week’s MBA Chart of the Week, we look at housing cost ratios by household income level, using data from the 2021 American Housing Survey.

MBA: February Mortgage Application Payments Up 5%

Homebuyer affordability declined in February, with the national median payment applied for by purchase applicants increasing 4.9 percent to $2,061 from $1,964 in January, according to the Mortgage Bankers Association’s monthly Purchase Applications Payment Index.

MBA: February Mortgage Application Payments Up 5%

Homebuyer affordability declined in February, with the national median payment applied for by purchase applicants increasing 4.9 percent to $2,061 from $1,964 in January, according to the Mortgage Bankers Association’s monthly Purchase Applications Payment Index.