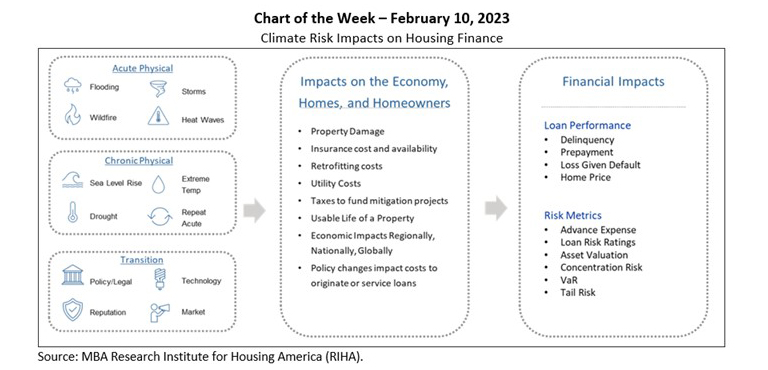

MBA Chart of the Week Feb. 10 2023: Climate Risk and Housing Finance

The Research Institute for Housing America, MBA’s think tank, released the first volume of A Collection of Essays on Climate Risk and the Housing Market that examines various aspects of how climate risk is impacting housing markets (as summarized in this week’s chart that replicates Exhibit 1 from the second essay).

The compendium features four essays from industry experts. Volume I includes two essays written by Ceres Accelerator for Sustainable Capital Markets, and RiskSpan Inc., respectively. The final two essays from the study will be released in Volume II in March—an essay by Milliman Inc. on climate change and insurance markets, and an essay by Andrew Davidson & Co. Inc. on incorporating climate risk into mortgage models.

Ceres’ essay, Housing Finance and Climate Risk: Taking Action in an Uncertain Future, emphasizes that:

- The housing and mortgage industries have a central and outsized role in mitigating the risks of climate change and financing the transition to a sustainable future.

- Managing climate-related risks, ensuring equitable access to credit, and meeting the nation’s pressing housing needs are linked to systemic challenges.

- Climate risks cannot be addressed by either government or the private sector alone, both must work together toward bold and innovative solutions.

- All mortgage originators have opportunities to raise borrowers’ awareness of climate-related risks and increase access to financing for improvements that make homes more resilient and sustainable.

Key takeaways from the second essay, A Practical Approach to Climate Risk Assessment for Mortgage Finance, authored by RiskSpan, include:

- The housing market faces unique risks from natural hazards and climate risk due to the nature of the asset and the intricacies of risk sharing (property insurer, homeowner, GSE, servicer, and investor).

- Acute climate events that seriously damage or destroy homes affect the timing of mortgage cash flows and can impact the overall performance of a mortgage portfolio, particularly when insurance proceeds are used to prepay loans.

- Home-price impacts due to climate change will ultimately depend on the extent to which potential homebuyers believe the climate poses a substantial risk to a given community. As information becomes more readily available (and believed), climate risk will gradually get priced into home values.

- Incorporating climate risk into existing enterprise risk management practices is likely a multi-year process. Initial goals should be to make incremental progress that can be iterated and improved over time.

- Incorporating scenario analyses into existing risk management activities will help build intuition and understanding within the organization related to climate risk.

—Edward Seiler eseiler@mba.org.