The time it takes for typical household to save for a down payment varies widely across the U.S., AD Mortgage found in a new report.

Tag: Down Payment

Redfin: Almost One-Quarter of Young Buyers Used Gift or Inheritance in Down Payment

Redfin, Seattle, released a new study finding that 23.8% of Gen Z or millennials who recently bought a home used some form of family money to help fund their down payment.

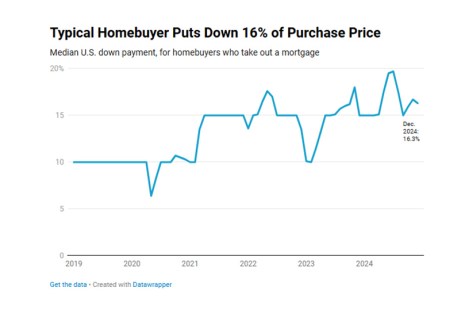

Redfin: Typical Buyer Putting Up 16.3% Down Payment

Redfin, Seattle, reported that the typical U.S. homebuyer’s down payment in December was 16.3% of the purchase price, up from 15% a year earlier.

Clever Real Estate: Buyers Pay More Than $30,000 on Top of Down Payment

Clever Real Estate, St. Louis, released a new study, finding that homebuyers are spending an average of $31,975 on expenses in addition to their down payment and closing costs.

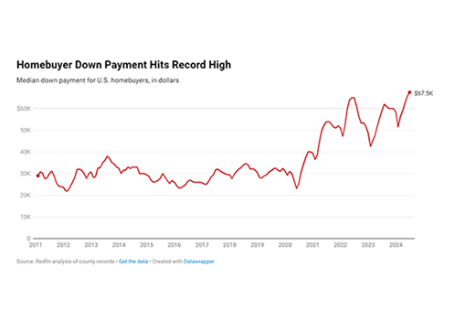

Redfin Reports Typical Down Payment Hits Record $67,500

The typical down payment for U.S. homebuyers hit a record $67,500 in June, up nearly 15% from $58,788 a year earlier, according to a new report from Redfin, Seattle.

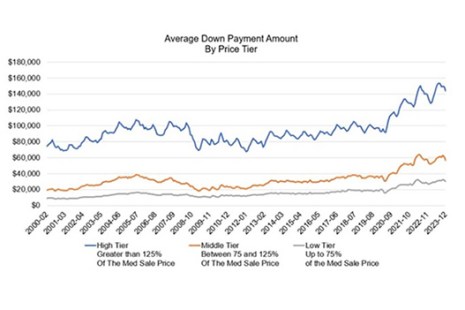

CoreLogic Reports Average Home Down Payment Reaches Record High

The average U.S. home down payment reached a record high last fall, according to CoreLogic, Irvine, Calif.

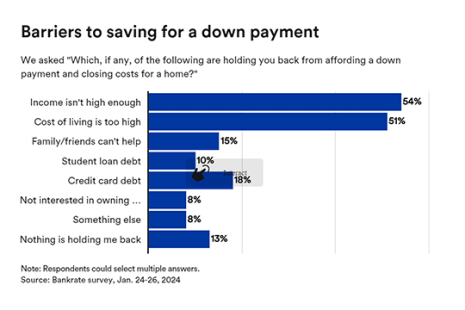

Many Aspiring Homeowners Cite Cost of Living, Insufficient Income as Roadblocks: Bankrate

More than half of aspiring homeowners say the current cost of living is too high or their income is not high enough to afford a down payment and closing costs for a home (51% and 54% respectively), reported Bankrate, New York.

Down Payments Fall 10% from Year Ago as Housing Market Cools

Redfin, Seattle, said the typical U.S. homebuyer’s down payment fell 10% year over year in January to $42,375, its lowest level in nearly two years.

Survey: 1 in 4 First-Time Homebuyers Use Stimulus Money for Down Payment

Redfin, Seattle, said nearly one-quarter (24%) of first-time homebuyers are using stimulus money for their down payment, the second-most common way after saving directly from paychecks.

Bruce Schultz of Gateway First Bank: Promoting Affordable Homeownership in the Age of COVID

The COVID-19 pandemic presents residential mortgage lenders with an opportunity to expand their role in a critically needed area of community development – advancing affordable homeownership.