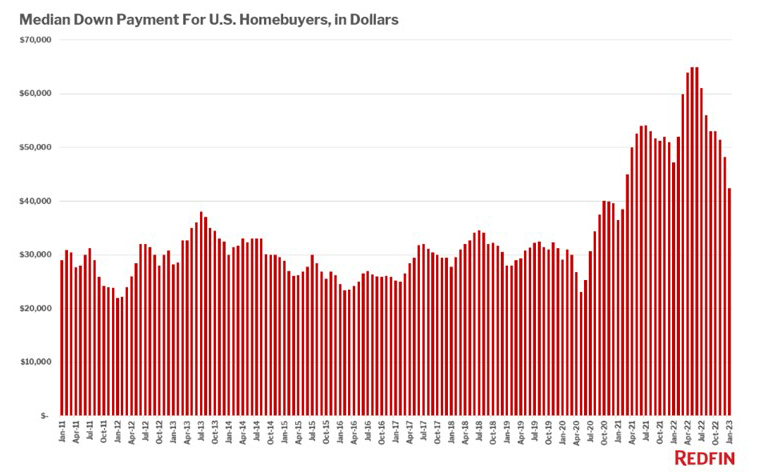

Down Payments Fall 10% from Year Ago as Housing Market Cools

Redfin, Seattle, said the typical U.S. homebuyer’s down payment fell 10% year over year in January to $42,375, its lowest level in nearly two years. The median down payment fell by 35% from the peak las June, but rose by more than 30% from pre-pandemic levels.

Redfin reported the median down payment in January was equal to 10% of the purchase price, down from 13.6% a year earlier and the pandemic-era peak of 17.5% in May. The last time down-payment percentages were this low was early 2021, before the pandemic homebuying boom drove buyers to put more money down to make their offers more attractive.

Redfin Senior Economist Sheharyar Bokhari said down payments are falling for several reasons:

• The housing market is slow and there’s not much competition. Most offers for homes written by Redfin agents don’t face bidding wars. That’s a stark difference from the hyper-competitive housing market of 2021 and early 2022. “Buyers no longer need to offer a big down payment to prove their financial stability and stand out from the crowd,” the report said. “Now that buyers often have the upper hand, they can offer an amount that works best for their individual circumstances. Diminished competition is also allowing more buyers to use FHA and VA loans, which typically allow for much smaller down payments. “

• High housing costs and inflation. 6%-plus mortgage rates, still-high home prices and inflation are hitting homebuyers’ pocketbooks hard. “Buyers don’t have as much money to allocate to a down payment because monthly housing payments are higher than before; they may also be putting more cash toward a mortgage-rate buydown instead of their down payment,” the report said. “Additionally, buyers may be inclined to hold onto as much cash as possible in these uncertain economic times.”

• Lower home prices = lower dollar down payments. The report noted home prices remain stubbornly high, but they have fallen more than 10% from their May 2022 peak and 1.5% from a year ago. A 10% down payment on a $400,000 home equals $40,000; if that same home was worth $450,000 in May, the buyer would have needed $45,000 for a 10% down payment.

“One silver lining of high mortgage rates and economic turmoil is that they’ve slowed competition,” Bokhari said. “That means buyers are often able to purchase a home without facing a bidding war and don’t need to fork over a huge portion of their savings for a down payment to grab sellers’ attention. Today’s buyers are also able to save money in other ways: Nearly half of sellers are offering concessions, like helping pay for a mortgage-rate buydown or covering closing costs, to attract buyers.”

Redfin noted nearly one-third (32.1%) of U.S. home purchases were paid for with all cash in January, up from 29.7% a year earlier and the highest share in nine years. Sixteen percent of mortgaged home sales used an FHA loan in January, up from 13.3% a year earlier and the highest share since April 2020. The share of mortgaged sales using VA loans rose to their highest level in more than two years, climbing to 7.5% from 6.1% a year earlier.

The report said FHA and VA loans, which typically allow for lower down payments than conventional loans, have become more prevalent as the market has cooled and affordability has waned.

“Most sellers are receiving just one offer for their home–a reversal from the hyper-competitive pandemic housing market–making sellers much more likely to accept FHA and VA loans,” the report said. “Sellers can’t afford to be picky about loan types if they receive just one offer.”

The report said conventional loans are still by far the most common type. More than three-quarters (76.3%) of borrowers used a conventional loan–but that’s the lowest share since June 2020.