CoreLogic Reports Average Home Down Payment Reaches Record High

(Illustration courtesy of CoreLogic)

The average U.S. home down payment reached a record high last fall, according to CoreLogic, Irvine, Calif.

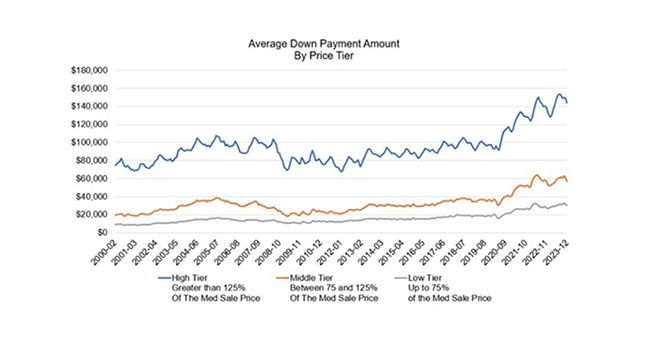

The average down payment amount dropped during the Great Recession but has steadily increased since then, CoreLogic reported. The average down payment has “surged” since the COVID pandemic, reaching a record high in October 2023, the report said.

“Home prices play a significant part in down payment sizes, and with the substantial appreciation of the last few years, average down payments have followed suit,” CoreLogic Principal Economist Archana Pradhan said. She added homebuyers’ average down payments were up by 8% year-over-year in December 2023.

The average down payment for a U.S. home was 16%, or roughly $84,000 in December, the report said.

In December 2023, the average down payment for lower-tier homes (those priced at less than 75% of the median sales price) was $29,987, up from $27,011 year over year, CoreLogic reported. The average down payment for middle-tier homes (those priced between 75% and 125% of the median sales price) was $56,371 in December, up from $53,031. The average down payment for homes priced at more than 125% of the median sales price was $143,681 in December, up from $133,340 a year before.

Mortgages for high-tier homes are mostly high-balance loans or jumbo loans, which generally require larger down payments, Pradhan noted.

Looking at various U.S. metros, CoreLogic found down payment percentages were highest in San Francisco (29%), followed by San Jose (28%) and Anaheim, Calif. (27%), Naples, Fla. (27%) and New York (26%).

“In general, high-cost areas experienced larger down payments, as buyers in these metros usually have higher incomes, which translates to more buying power,” Pradhan said. “The other potential reason is that the buyers would prefer to reduce monthly mortgage payments to offset the impact of higher rates.”