Intercontinental Exchange, Atlanta, released its “first look” at September 2023 month-end mortgage performance data, finding the national delinquency rate rose to 3.29%.

Tag: Delinquency Rate

CoreLogic: Mortgage Delinquencies Remain Near Record Low in July

CoreLogic, Irvine, Calif., released its Loan Performance Insights through July, revealing strong performance–overall delinquencies were 2.7%, still near a record low.

CoreLogic: Mortgage Delinquencies Remain Near Record Low in July

CoreLogic, Irvine, Calif., released its Loan Performance Insights through July, revealing strong performance–overall delinquencies were 2.7%, still near a record low.

CoreLogic: Mortgage Delinquencies Remain Near Record Low in July

CoreLogic, Irvine, Calif., released its Loan Performance Insights through July, revealing strong performance–overall delinquencies were 2.7%, still near a record low.

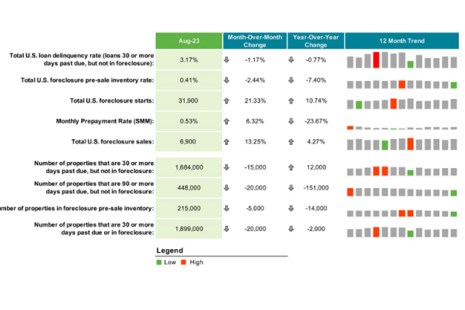

Black Knight: First Look August Delinquency Numbers Positive

Black Knight, Jacksonville, Fla., released its First Look at its August Mortgage Monitor, finding that the delinquency rate improved yet again, but gains are slowing. That, Black Knight said, might suggest delinquency rates are reaching cycle lows.

Black Knight: First Look August Delinquency Numbers Positive

Black Knight, Jacksonville, Fla., released its First Look at its August Mortgage Monitor, finding that the delinquency rate improved yet again, but gains are slowing. That, Black Knight said, might suggest delinquency rates are reaching cycle lows.

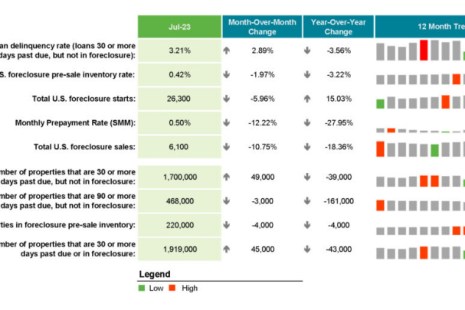

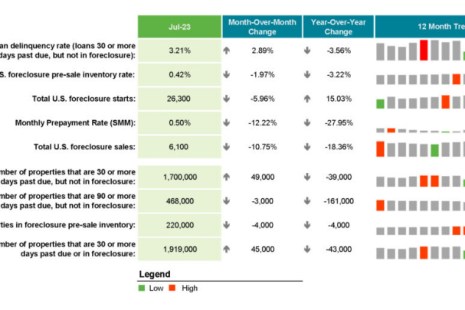

Black Knight: Foreclosure Inventory Very Low, Serious Delinquencies Down in July

Black Knight, Jacksonville, Fla., reported its “first look” at July 2023 mortgage performance statistics, finding that serious delinquencies continue to improve.

Black Knight: Foreclosure Inventory Very Low, Serious Delinquencies Down in July

Black Knight, Jacksonville, Fla., reported its “first look” at July 2023 mortgage performance statistics, finding that serious delinquencies continue to improve.

Black Knight: Foreclosure Inventory Very Low, Serious Delinquencies Down in July

Black Knight, Jacksonville, Fla., reported its “first look” at July 2023 mortgage performance statistics, finding that serious delinquencies continue to improve.

CoreLogic: Mortgage Delinquency Rate at Record Low in May

CoreLogic, Irvine, Calif., reported in May just 2.6% of all mortgages in the U.S. were in some stage of delinquency, matching the all-time low.