Mortgage loans led an increase in early- and mid-stage delinquencies across all credit categories in May, according to new CreditGauge report from VantageScore, San Francisco, Calif.

Tag: Delinquency Rate

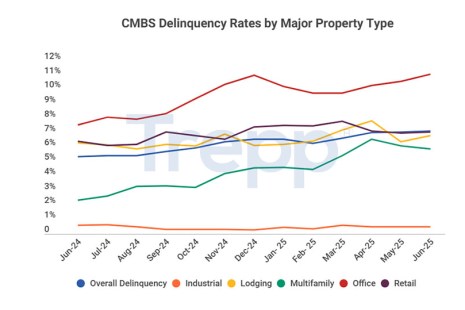

Trepp: CMBS Delinquency Rate Up; Office Hits High

Trepp, New York, reported that the CMBS delinquency rate rose in June, up 5 basis points to 7.13%.

Trepp: CMBS Delinquency Rate Increased Slightly in May

Trepp, New York, reported that its CMBS delinquency rate rose to 7.08% in May, up five basis points.

ICE First Look: Delinquencies Edge Up in March Year-Over-Year

Intercontinental Exchange released its March First Look report, showing the delinquency rate was up slightly year-over-year to 3.21%.

Trepp: CMBS Delinquency Rate Decreases in February

Trepp, New York, found the CMBS Delinquency Rate fell in February, with the overall rate decreasing 26 basis points to 6.3%.

CoreLogic: U.S. Overall Delinquency Rate at 3.1% in December

CoreLogic, Irvine, Calif., reported that the U.S. overall delinquency rate was flat year-over-year, but dropped slightly from November.

2025 Opens with Lower CMBS Delinquency Rate, Fitch Finds

The overall U.S. commercial mortgage-backed securities delinquency rate decreased by three basis in January to 2.95%, according to Fitch Ratings, New York.

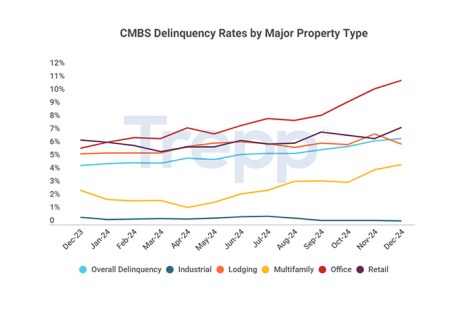

Trepp Reports CMBS Delinquency Rate Rises Again in December

Trepp, New York, reported its CMBS delinquency rate rose in December, with the overall rate up 17 basis points to 6.57%.

CoreLogic: Delinquency Rate Rises Slightly in September

CoreLogic, Irvine, Calif., reported that for September, 3% of all mortgages were in some stage of delinquency.

ICE First Look: Delinquencies Edge Up, but Foreclosure Activity Still Low

Intercontinental Exchange Inc., Atlanta, provided its first look at October mortgage performance, finding that the delinquency rate hit 3.45% in October, up 6% from October 2023.