CoreLogic: Mortgage Delinquency Rate at Record Low in May

(Image courtesy CoreLogic)

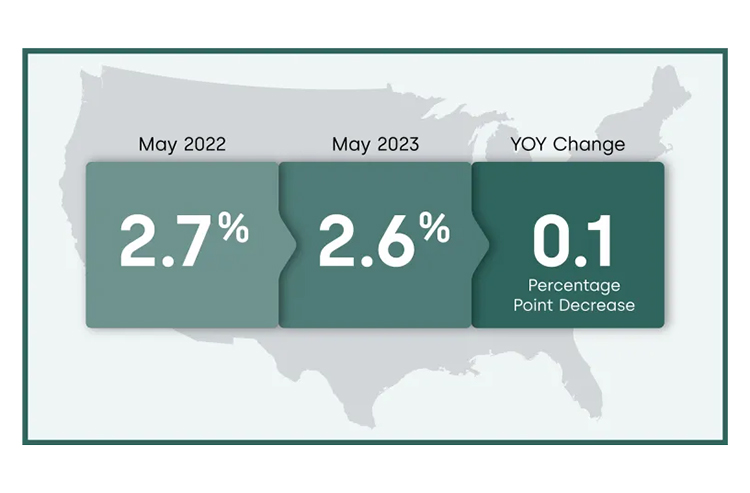

CoreLogic, Irvine, Calif., reported in May just 2.6% of all mortgages in the U.S. were in some stage of delinquency, matching the all-time low.

The metric was down from 2.7% in May 2022 and down from 2.8% sequentially in April.

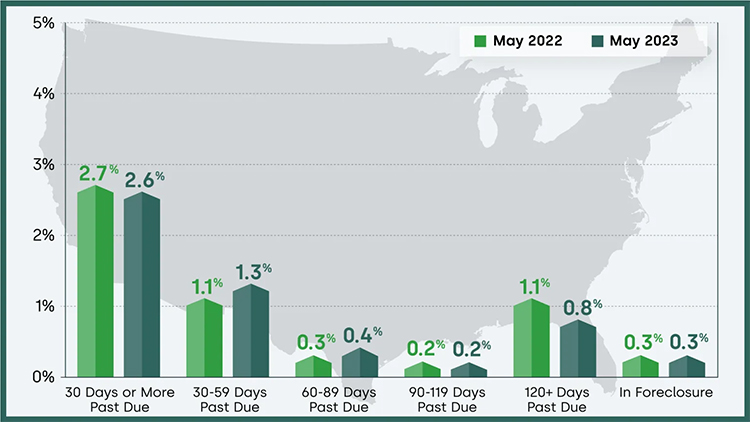

In terms of different stages of delinquency:

• Early-Stage Delinquencies, defined as 30 to 59 days past due: 1.3%, up from 1.1% in May 2022.

• Adverse Delinquency, defined as 60 to 89 days past due: 0.4%, up from 0.3% in May 2022.

• Serious Delinquency, defined as 90 days or more past due, including loans in foreclosure: 1%, down from 1.3% in May 2022 and a high of 4.3% in August 2020.

• Foreclosure Inventory Rate, defined as the share of mortgages in some stage of the foreclosure process: 0.3%, unchanged from May 2022.

• Transition Rate, defined as the share of mortgages that transitioned from current to 30 days past due: 0.6%, unchanged from May 2022.

“May’s overall mortgage delinquency rate matched the all-time low, and serious delinquencies followed suit,” said Molly Boesel, Principal Economist at CoreLogic. “Furthermore, the rate of mortgages that were six months or more past due, a measure that ballooned in 2021, has receded to a level last observed in March 2020.”

Boesel pointed to the current strong job market as helping to ensure borrowers are able to make timely payments.

On a regional note, 14 states saw an annual increase in overall delinquency rates. Idaho, Indiana, Michigan, Mississippi and Pennsylvania saw the largest increases, all up 0.2 percentage point.

Additionally, 168 metro areas posted an annual increase in overall delinquency rates. Three metro areas posted an increase in serious delinquency rates: Cape Coral-Fort Myers, Fla., and Punta Gorda Fla., up by 0.7 percentage point and Elkhart-Goshen, Ind., up by 0.2 percentage point.