Physicists have protons, neutrons, and electrons. Biologists have DNA and RNA. And economists have supply and demand — the building blocks upon which most of our understanding of markets rest.

Tag: CRE

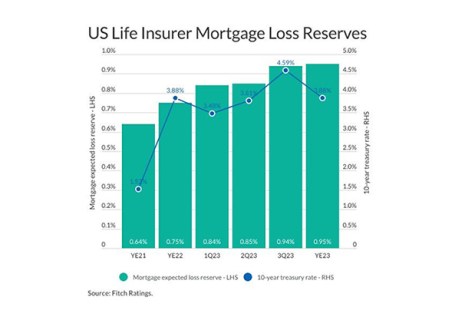

Fitch: Life Insurers CRE Risks Grow; Remain Within Ratings Expectations

Fitch Ratings, New York, said the U.S. life insurance sector has “material exposure” to commercial real estate, but noted insurer ratings are unlikely to move due to potential CRE losses.

Moody’s Reports Higher Interest Rates Driving Down Defeasance

Moody’s Investors Service, New York, reported commercial mortgage-backed securities defeasance activity tumbled last year to $11.4 billion from $32.2 billion in 2022.

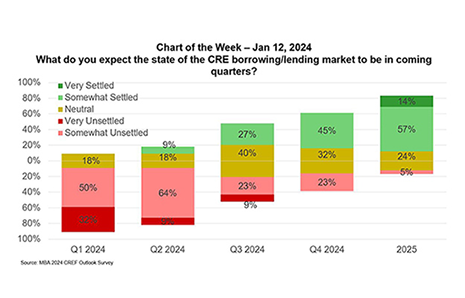

MBA Chart of the Week: Expectations for the CRE Borrowing/Lending Market

Even though many commercial real estate loans are long-lived, there’s a sense that the industry starts each year fresh. Sometimes, that means losing credit for all the deals and successes of the previous twelve months. Sometimes – like now – it means being able to put last year in the rearview mirror.

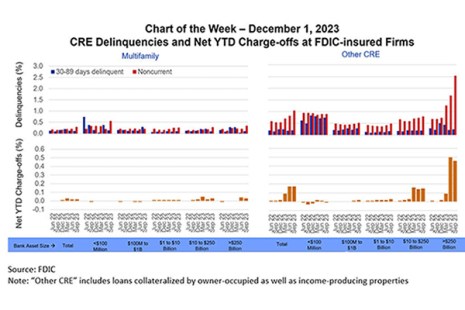

MBA Chart of the Week: CRE Delinquencies and Net YTD Charge-offs at FDIC-Insured Firms

Since March 2023, a recurring set of questions has revolved around a) how conditions in commercial real estate are affecting banks and b) how conditions with banks are affecting CRE.

Fitch: Life Insurers Well Positioned to Withstand Commercial Real Estate Exposure Risks

Fitch Ratings, New York, said the life insurance companies it has rated are well positioned to withstand the mounting challenges from rising losses and falling commercial real estate valuations.

S&P: Pension Funds Increase Real Estate Exposure

S&P Global Market Intelligence, New York, reported U.S. public pension funds are increasing their allocations to real estate as a hedge against volatile market conditions.

CRE Market Sentiment Improves to 2015 Level

CRE executives’ market sentiment has improved dramatically from a year ago, reported RCLCO, Washington, D.C.

Priced to Perfection: CRE Values Inch Up

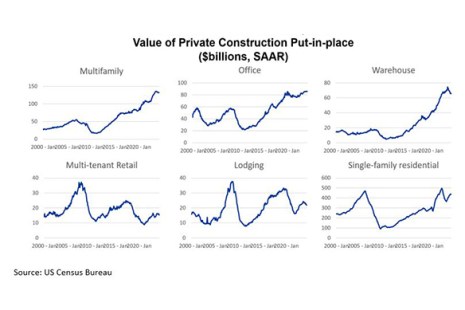

As the anniversary of COVID significantly impacting the U.S. and commercial/multifamily property markets passes, challenging questions about property values remain top of mind.

Institutions Increase Commercial Real Estate Allocations

COVID-19 has not dampened global institutions’ confidence in commercial real estate.