Marcus & Millichap, Calabasas, Calif., said the commercial real estate lending landscape has improved from the pandemic’s early days, when lenders and investors paused to assess the coronavirus’s impact.

Tag: CRE

CRE Fundamentals Struggle to Find Secure Footing

Challenging times for CRE fundamentals are likely to extend into 2021, but there is light at the end of the tunnel, said Wells Fargo Securities, Charlotte, N.C.

Financial Institutions Face Risks To CRE Asset Quality

S&P Global Ratings, New York, said both banks and non-bank financial institutions face risks from their commercial real estate exposure due to the COVID-19 pandemic’s impact on travel, shopping and office usage.

‘Sluggish’ Acquisitions Slow Third-Quarter Commercial Lending Activity

“Sluggish” commercial real estate investment activity caused loan closings to slow in the third quarter, reported CBRE, Los Angeles.

Along Came COVID: Emerging Tech Trends in Commercial Real Estate Finance

Emerging technologies and start-up firms proliferated in commercial real estate over the last several years. With the conventional wisdom being that while the single-family real estate finance industry has embraced new technologies and innovation, CRE was a laggard and therein lies a massive opportunity.

CRE Asset Prices Creep Higher

Real Capital Analytics, New York, reported U.S. commercial property prices posted a 1.6 percent year-over-year gain in August.

CRE Prices Slip, Sales Volume Tumbles

Commercial real estate asset prices dipped in July while sales volume fell significantly, said Real Capital Analytics and CoStar Group.

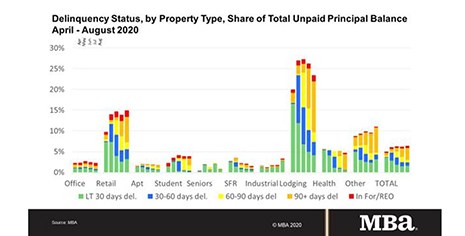

MBA: Pandemic Takes Aim at Commercial, Multifamily Mortgage Delinquency Rates

The coronavirus pandemic had a “dramatic and immediate impact” on delinquency rates for some mortgages backed by commercial and multifamily properties in the second quarter, although most continued to perform well, the Mortgage Bankers Association said today in two reports.

CRE at a Crossroads

The coronavirus pandemic has put commercial real estate “at a crossroads,” said Yardi Matrix, Santa Barbara, Calif.

Report Cites ‘Historic’ Drop in CRE Completions

Reis, New York, reported commercial real estate completions have declined “in a historic manner” since the pandemic and shutdown orders hit the U.S.